Profile

Legal Structure

Sargodha Jute Mills

Limited (hereafter referred to as “Sargodha Jute” or “the Company”) was

established on February 10, 1981, as an unlisted Public Limited Company under

the provisions of the repealed Companies Act, 1913 (now replaced by the

Companies Act, 2017). The Company’s registered office is located at 19-B, Off

Zafar Ali Road, Gulberg-V, Lahore, while its regional office is located at 309

Uni Tower, 3rd Floor, I.I. Chundrigar Road, Karachi.

Background

The Company was founded

in 1981 by the late Mian Muhammad Aslam. The group operates one jute mill and

one textile mill. Following the founder's tenure, the operations of Sargodha

Jute were entrusted to his son, Mian Parvez Aslam. Subsequently, the leadership

transitioned to the next generation, with the two sons of Mian Parvez Aslam

serving as the Chairman and CEO of the Company.

Operations

The core business

activity of the Company revolves around the manufacturing, sale, and

distribution of jute products, leveraging efficient machinery to maintain high

standards of quality and operational effectiveness. Sargodha Jute Mills Limited

offers a diverse product portfolio, which includes yarn, hessian cloth, hessian

bags, sacking bags, and twines. Additionally, the Government of Pakistan is a

key contributor to the Company’s revenue through substantial procurement of

sacking bags. The Company’s installed production capacity is ~30,500 MT/annum

(based on 360 operational days), with a utilization rate of ~38.54% in FY24

(FY23: ~75.07%).

Ownership

Ownership Structure

Mr. Parvez Aslam and his

family collectively hold a majority ownership stake of ~75% in the Company.

Within this, his sons, Mr. Irfan Aslam and Mr. Imran Aslam, each own a 28.32%

share. Additionally, Shahzad Textile Mills Limited, an associated company,

holds a 24.94% ownership stake in Sargodha Jute.

Stability

While there is currently

no formal succession plan in place, the ownership of shares and business roles

is evenly divided between the two sons of Mr. Parvez Aslam, Mr. Imran Aslam and

Mr. Irfan Aslam. Mr. Irfan Aslam serves as the CEO of Sargodha Jute Mills

Limited, while Mr. Imran Aslam holds the position of CEO at Shahzad Textile

Mills Limited. Establishing formal documentation for succession planning could

significantly enhance the long-term stability and continuity of the Company.

Business Acumen

Mr. Irfan Aslam, serving

as the CEO of Sargodha Jute Mills Limited, brings over two decades of extensive

experience in overseeing the Company’s operations. His strong strategic acumen

and ability to make timely, effective decisions have been instrumental in

steering the Company towards sustained growth and stability.

Financial Strength

Mr. Irfan Aslam holds a 24.85%

ownership stake in the associated company, Shahzad Textile Mills Limited, which

boasts a robust asset base of ~PKR 5.9bln as of Jun’24. In addition to his

business interests, Mr. Irfan Aslam demonstrates a strong financial acumen

through active investments in diverse sectors, including real estate, the stock

market, and foreign exchange markets. The Company is expected to get timely

support from its sponsors, if needed.

Governance

Board Structure

The Company's board

comprises three members, two of whom belong to the sponsoring family. Mr.

Irfan, serving as the CEO, and Mr. Ahsan, acting as the COO, hold executive

director positions. Meanwhile, Mr. Imran, who chairs the board, serves as a

non-executive director. The compact size of the board, with key leadership

roles primarily held within the sponsoring family, reflects a concentrated and

efficient decision-making approach. However, an independent oversight could

enhance the governance structure, fostering greater transparency and balance in

strategic decision-making.

Members’ Profile

Mr. Irfan Aslam, a

graduate of a prestigious foreign university, brings over two decades of

expertise in the jute industry and currently serves as the CEO of Sargodha Jute

Mills Limited. While Mr. Imran Aslam, with a strong foothold in the textile

sector, holds the position of CEO at Shahzad Textile Mills Limited. Their

extensive experience and leadership have been pivotal in driving the Company’s

growth and sustainability.

Board Effectiveness

The board’s overall

effectiveness is hindered by its limited size and the significant influence of

the sponsoring family, which may affect diverse and balanced decision-making.

Additionally, the practice of board meetings held on an “as and when needed”

basis reduces the opportunity for structured and regular oversight.

Furthermore, the lack of independent directors and the absence of specialized

board committees limit the board’s ability to provide robust governance and

strategic guidance.

Financial Transparency

Crowe Hussain Chaudhry

& Co., Chartered Accountants, a QCR-rated firm and listed in the category ‘A’

on SBP’s panel of auditors, serve as the Company’s external auditors. They have

expressed an unqualified opinion on the annual financial statements for the

year ended June 30, 2024.

Management

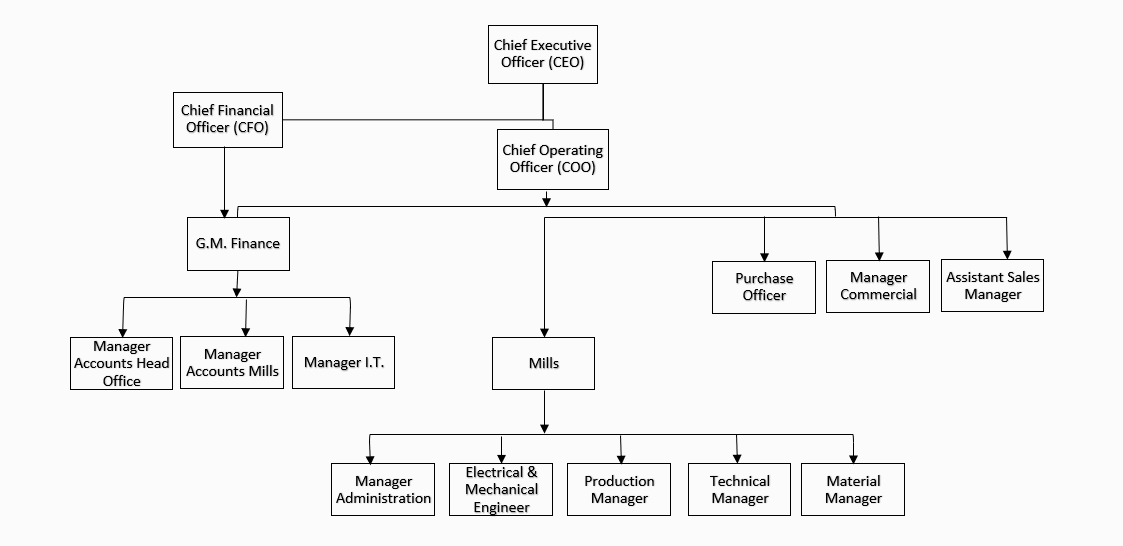

Organizational Structure

The Company’s

organizational framework is structured into two primary divisions: the Head

Office and the Mills. All key positions within the organization are filled. Major

functional departments include, (i) Accounts & Finance, (ii) Procurement,

and (iii) Production. The Chief Financial Officer (CFO) directly reports to the

Chief Executive Officer (CEO), establishing a clear financial oversight

hierarchy. Meanwhile, the Purchase Manager and Manager Commercial from the Head

Office, along with the Mill Managers, report to the Chief Operating Officer

(COO), fostering streamlined coordination between the operational and

managerial divisions.

Chart 1: Organizational Structure

Management Team

Mr. Irfan Aslam, the CEO,

is a graduate of a reputed foreign university and brings over two decades of

extensive experience in the jute industry. He holds the authority to make

strategic decisions for the Company, ensuring its continued growth and success.

Supporting him is Mr. Imran Haider, the CFO, who has been associated with the

group for nine years and has served in his current role for one year. Mr. Ahsan

Ahmad Khan, the COO, has dedicated 29 years to Sargodha Jute Mills Limited and

possesses a wealth of experience in the jute industry and oversees day-to-day

operations. Another key team member is Mr. Ayyaz Ali Shahid, the Manager

Commercial, who has been with the Company for the past seven years. He

specializes in raw jute procurement from Bangladesh, a critical component of

the Company’s supply chain. Additionally, the finance department is primarily

headed by Mr. Tahir, the General Manager of Finance, who ensures effective

financial management and oversight within the organization.

Effectiveness

With the support of a highly skilled and experienced team of

professionals, Sargodha Jute continues to enhance its business capabilities.

The management functions are well-defined and supported by a strong IT

infrastructure and comprehensive internal controls, enabling effective

operational oversight and decision-making. However, the lack of management

committees and internal audit function limits the ability to ensure seamless

communication and coordination across various functions.

MIS

Sargodha Jute Mills uses

oracle-based ERP system by the name of Wizmen. Regular reporting of sales

figures, raw materials positions, payables & receivables and income

statement on monthly basis is shared with top management. Secondly, the Company

uses Kaspersky registered antivirus software to protect the data of the

Company. On the other hand, data from the production facility is shared on

real-time basis because point to point link has been developed between the mill

and head office.

Control Environment

The Company is ISO 9001-2015 certified, reflecting its adherence to

internationally recognized quality management standards. A dedicated quality

control department ensures the consistent delivery of high-quality products to

customers. Additionally, the Company has implemented an efficient system for

addressing customer complaints and providing prompt resolutions, further

enhancing customer satisfaction. However, the establishment of an internal

audit function could strengthen transparency and reinforce internal controls,

contributing to a more robust governance framework.

Business Risk

Industry Dynamics

Pakistan’s economy is

facing serious challenges such as uncertain economic conditions, high energy

costs, high interest rates and inflation. These factors present a serious

challenge for a business; by increasing costs on one hand and by decreasing consumers’

buying power on the other hand. In the coming year, further reduction in

interest rates is expected, however, economic recovery is also expected to

remain slow in coming year. During FY24, the domestic market capitalization of

the Jute Sector was valued at ~PKR 33.5bln, marking a substantial year-on-year

(YoY) growth of ~18.8% compared to PKR 28.2bln in the previous year. From FY19

to FY23, the average production levels of jute goods were ~65,000 metric tons

(MT). However, in FY24, total jute goods production witnessed a sharp decline

of ~35.0%, dropping to ~41,000 MT from ~63,000 MT in FY23. Among the various

product categories, sacking bags maintained their leading position,

contributing ~65.9% to the total production in FY24, with output recorded at

~26,500 MT, representing a YoY decrease of ~43.8%. Other product categories,

such as Hessian Cloth and Miscellaneous Products, accounted for ~26.8% and

~7.3% of the total production, respectively, during FY24. Likewise, the

production utilization of the sector’s key players declined in the current

year. The installed production capacity of the five major players in the local

Jute Mills Sector remained unchanged and stood at ~114,300 MT in FY24. Notably,

Thal Limited and Sargodha Jute Mills collectively dominated the market, holding

a combined share of ~75% of the sector’s total production capacity.

Relative Position

The jute industry in

Pakistan comprises only a few key players, creating a concentrated competitive

landscape. Sargodha Jute ranks as one of the two largest players in the sector,

boasting an annual installed production capacity of 30,500 MT. As per the

management, the Company holds a market share of ~40%. Thal Jute Mills, the

largest competitor, holds a slightly higher market share, supported by its

marginally larger installed capacity of 33,800 MT. The remaining market share

is distributed among smaller players, including White Pearl Jute Mills, Indus

Jute, and Madina Jute, each contributing a relatively modest portion to the

industry landscape.

Revenues

Sargodha Jute Mills

Limited’s turnover faced significant pressure in FY24, as revenue contracted by

~36.4% to ~PKR 5,162mln, down from ~PKR 8,113mln in FY23. This marked

deterioration stemmed from various factors. Export sales witnessed a sharp

decline of ~46.5%, primarily driven by elevated production costs, which eroded

the competitiveness of the Company in global markets. Domestically, the prior

year benefitted from an unusually high level of jute bag procurement by the

government, a demand surge that was not sustained in FY24.

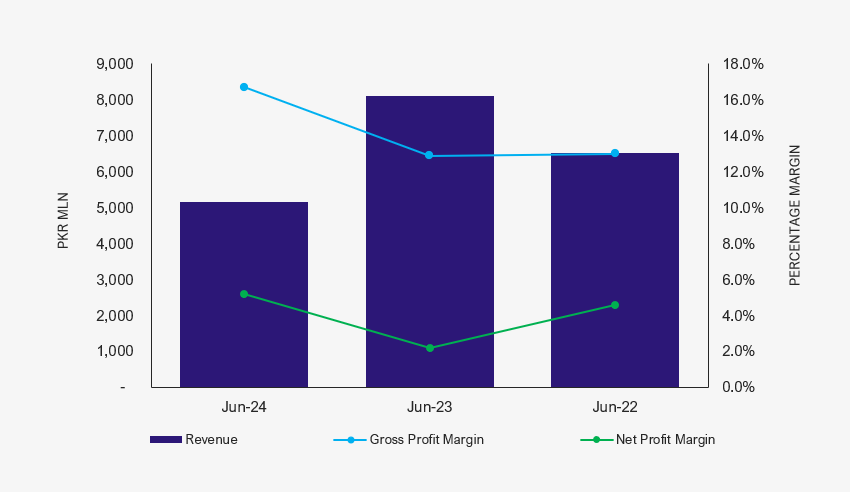

Graph 1: Revenue & Margins

Margins

During FY24, the Company

demonstrated a notable improvement in profitability metrics. The gross margin

increased to ~16.7% (FY23: ~12.9%, FY22: ~13%), primarily driven by enhanced

cost efficiencies. Similarly, the operating margin improved to ~12.1% in FY24,

up from 9.3% in FY23 (FY22: ~9.2%), reflecting better operational performance. Furthermore,

the net profit margin recorded a significant rise, reaching ~5.2% in FY24

(FY23: ~2.2%, FY22: ~4.6%). This substantial increase was largely attributable

to a rise in other income, showcasing the Company’s ability to improve and

sustain its bottom line despite external challenges.

Sustainability

The Company remains

proactive in addressing the challenges by implementing strategic measures to

mitigate adverse impacts. To reduce escalating energy costs, the Company is

actively investing in renewable energy solutions. An extension of 420 KW was

completed after June 2024, with a further expansion of 1,500 KW underway and

expected to become operational by April 2025. This will bring the total solar

energy capacity at the mills to 2.2 MW, demonstrating the Company’s commitment

to sustainability and cost efficiency. Jute bags remain the Company’s flagship

product, valued for their environmentally friendly and biodegradable

properties. With growing social awareness and a global shift towards eco-friendly

products, jute bags are well-positioned to become the preferred choice among

consumers, further enhancing the Company’s market appeal and long-term

sustainability.

Financial Risk

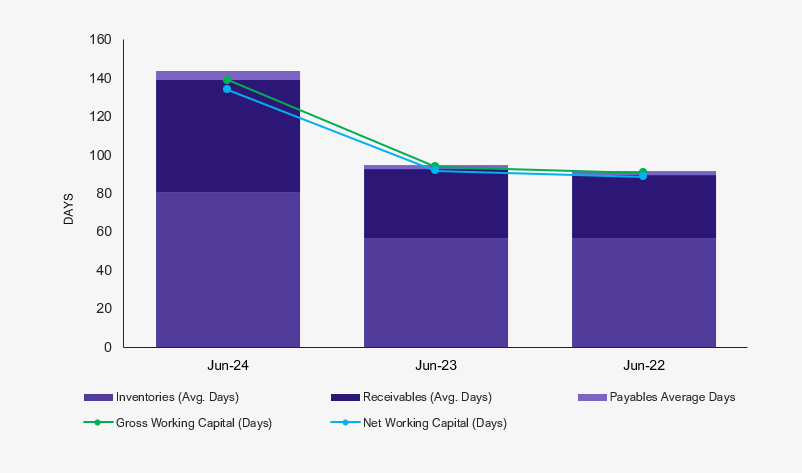

Working capital

During FY24, the Company’s gross working capital days rose to 139 days

(FY23: ~94 days, FY22: ~91 days),

reflecting an extension of the cash cycle. Similarly, net working capital days

increased to 134 days in FY24 (FY23: ~92 days, FY22: ~16 days). This decline was

primarily attributable to elevated inventory levels, driven by the unusually

high procurement of jute bags by the government in the preceding year and the

subsequent carryover of inventory disturbed the Company’s cash conversion cycle.

Graph 2: Working Capital Cycle

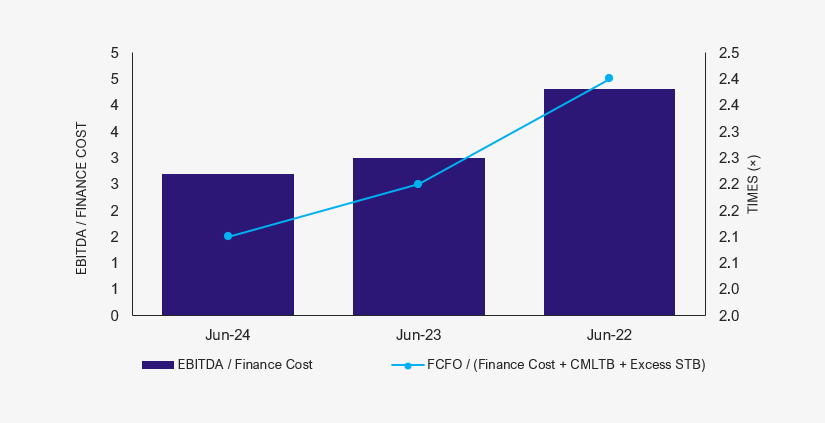

Coverages

During FY24, free cash

flows from operations also remained the same at ~PKR 621mln (FY23: ~PKR 658mln,

FY22: ~PKR 492mln). Interest coverage ratio is slightly under stress mainly on

the back of a significant surge in finance costs which stood at ~PKR 323mln in

FY24 (FY23: ~PKR 327mln, FY22: ~PKR 173mln). Company’s investment portfolio consists

of ~PKR 426mln TDRs and ~PKR 276mln listed equity security investments.

Graph 3: Financial Coverages

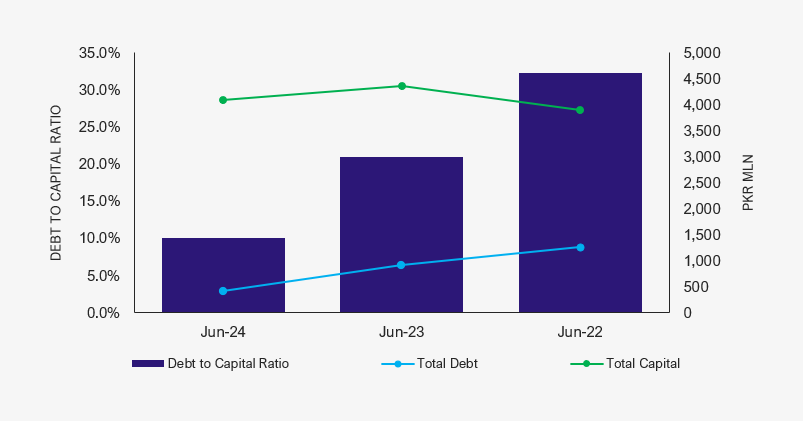

Capitalization

The Company has gradually

reduced its borrowings and increased its equity on the back of revaluation of

assets resulting in a reduced leverage of 10.0% in FY24 (FY23: 20.9%, FY22:

32.3%). Total borrowings of the Company decreased to ~PKR 410mln (FY23: PKR

909mln, FY22: PKR 1,260mln). The debt portfolio solely comprises short-term

borrowings to meet the working capital needs of the Company.

Graph 4: Capital Structure

|