Profile

Legal Structure

Salman Paper Products (Pvt.) Limited (or "the Company") was incorporated as a Private Limited Company under the Companies Ordinance,

1984 in October 2011.

Background

In 2005, Salman Paper Products was established as Jilani Enterprises and in 2011 Jilani Enterprises was renamed to Salman Paper Products Private Limited.

The Company is primarily engaged in the import, cutting and sizing, printing and trade of paper in the local market.

Operations

Salman Paper Products (Pvt.) Limited deals in four products; namely: Art cards, Packaging board, Stickers, and Printer paper. The Company imports the

paper from China, Malaysia, and Indonesia and sells to northern, central, and southern regions of Pakistan. Customers of the Company are divided into direct customers

and dealers (who resell to other customers). Among the dealers 4 are located in the central region, 2 are located in the northern, and 2 dealers are in the southern region of

Pakistan

Ownership

Ownership Structure

The Company is privately owned by two shareholders - Majorly by Mr. Muhammad Aslam Jilani: 99% shares and remaining 1% shares by Mr.

Muhammad Faisal.

Stability

Ownership structure is stable as owners have vast experience in the packaging industry while having a personal stake in business. Being part of a group wherein

tacit intergroup cooperation exists, bodes well to the rating.

Business Acumen

Mr. Aslam Jillani brings over 20 years of experience in the sector, during which he has gained extensive knowledge of business processes and industry trends through his broad associations and expertise.

Financial Strength

The light asset and high turnover base model of business has provided strength to the Company to establish its brand name amongst the leading

importers of paper and related products in the south market.

Governance

Board Structure

The BoD of the Company comprises of 2 members who are also owners. Mr. Muhammad Aslam Jilani is the executive director and Mr. Muhammad Faisal

is the non-executive director of the Company.

Members’ Profile

Mr. Muhammad Aslam Jilani with his extensive experience of more than 20 years, looks after the governance side of the

business. He has developed excellent business relationships with buyers and suppliers.

Board Effectiveness

The Board has only two members and in comparison, to established corporates, the governance model is weak and needs improvement. The Board

has no formal committees to assist the board.

Financial Transparency

M/s Mushtaq & Co. Chartered Accountants are the external auditors of the Company. They have expressed an unqualified opinion on the

financial reports of Salman Paper Products (Pvt.) Limited for period ending Jun-24. The firm is QCR rated by ICAP and is in the "B" Category of SBP’s panel of auditors.

The absence of an internal audit function further creates room for improvement in the corporate governance framework.

Management

Organizational Structure

Salman Paper Products (Pvt.) Limited has developed a defined organizational structure keeping in mind the Company’s operational needs.

Currently, the organizational structure is divided into four main functions namely; 1) Sales & Marketing 2) Purchase 3) Accounts & Finance, and 4) Collection &

Recovery.

Management Team

The management team consists of the owners, with Mr. Muhammad Aslam Jilani serving as the CEO, and Mr. Faisal Iqbal holds the position of Chief Operating Officer, overseeing the Company’s major operations.

Effectiveness

The experience of the sponsors along with a professional management team has helped the Company to streamline its operations. However, Management’s

effectiveness and efficiency can be ensured through the presence of management committees. At Salman Paper Products (Pvt.) Limited, absence of management

committees are indicating the room for improvement.

MIS

The Company’s Management Information System (MIS) produces detailed financial reports on a monthly basis. In addition, the MIS prepares various management reports that offer valuable insights for senior management’s evaluation. These reports are designed to aid in informed decision-making by focusing on key performance indicators, financial trends, and operational metrics. The company utilizes SAP Business ERP software to generate both MIS and operational reports.

Control Environment

For identification, assessment, and reporting of all types of risk arising out of the business operations because there is no internal audit department

in place to ensure operational efficiency which operates under the direct supervision of directors.

Business Risk

Industry Dynamics

Pakistan’s

packaging industry consists of four major segments, paper, plastic, tinplate

and glass. Paper and plastic segments occupy the major share in total market.

Despite, the economic slowdown caused by several issues, demand for the segment

remained almost consistent as it falls in the supply chain of various essential

products and industries. The segment’s direct costs consist largely of imported

raw materials. Chemical wood pulp is one of the main raw materials in the

production of paper packaging. Therefore, volatility in exchange rates and

international price trends has an impact on costs.The production levels of Paper over the last five years have experienced

a CAGR of ~7.2%. This reflects the stability of the segment as it makes up a

significant portion of overall Paper and board production. The production of

Paper increased in FY24 to ~366,267MT from ~311,675MT in FY23 with an increase

of ~17.6% YoY. (Source: PACRA Sector Study)

Relative Position

Salman Paper Products (Pvt.) Limited maintains a strong market presence in Pakistan for importing Art cards, Packaging board, Stickers, and Printer

paper, holding a significant share in these product categories.

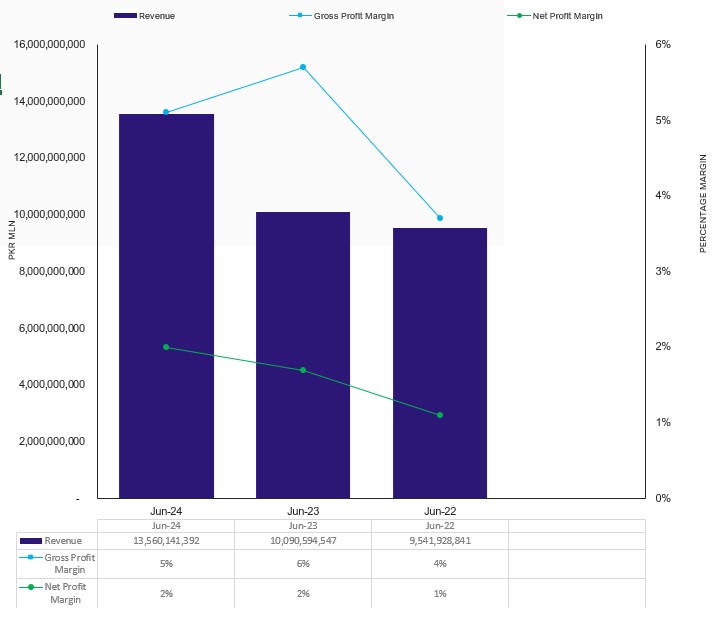

Revenues

The Company’s top line shows an increasing trend due to increase in sale price but the increase in prices of products has impacted demand. During FY24, the Company generated a top

line of ~PKR 13,560mln (FY23: ~PKR 10,091mln, FY22: ~PKR 9,542mln), showing an increase of ~ 34% in revenue.

Margins

The paper rolls used by the Company are entirely imported, and to maintain its profit margins, the Company passes on the increased costs to its B2B consumers. In FY24, the gross profit margin declined from ~5.7% in FY23 to ~5.1% due to a rise in the cost of goods sold. Similarly, the operating profit margin decreased from ~5.2% to ~4.5% during the same period, driven by an increase in operating expenses. However, the net profit margin improved, rising from ~1.7% to ~2.0%, reflecting an increase in net income. The Company's bottom line for FY24 reached PKR 273mln, up from PKR 171mln in FY23 (FY22: PKR 104 mln).

Sustainability

Salman Paper Products (Pvt.) Limited has a well-established brand name in the market, especially in Art cards, Packaging board, Stickers, and Printer

paper products.

Financial Risk

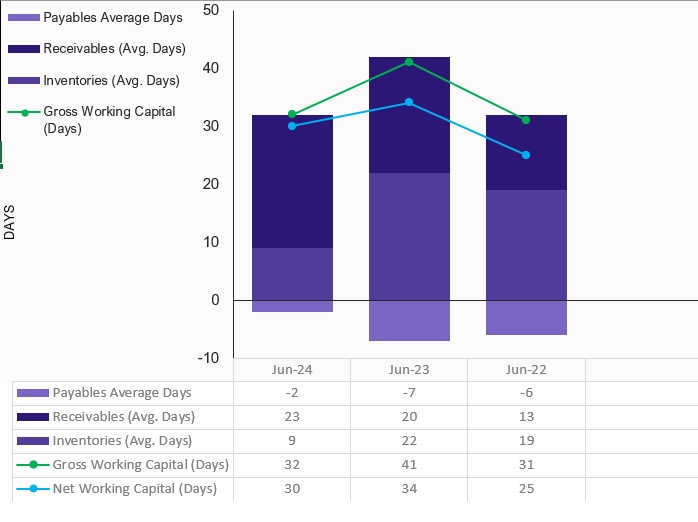

Working capital

Salman Paper Products (Pvt.) Limited has seen a significant improvement in its inventory turnover, inventory days decreasing from ~22 days at end-Jun23 to ~9 days at end-Jun24. This reduction in inventory days reflects the company's enhanced operational efficiency and stronger inventory management, resulting in a faster turnover of stock and improved overall business performance. The trade

receivable days increased from ~20 days to ~23 days during the same period. But the trade payable days decreased from ~41 days at end FY23 to ~32 days at end FY24.

Consequently, the Company’s net working capital days decreased to ~29 days at end FY24 from ~35 days at the end of FY23.

Coverages

In FY24, the Company’s FCFOs stood at ~PKR 398mln FY24 decreasing from ~PKR 463mln in FY23 (FY22: ~PKR -136mln). As result during FY24,

FCFO/Finance cost stood at ~ 2.2x FY24 decreased from ~ (2.7x) of coverage during FY23 (FY22: ~-1.4x). The finance cost stood at ~PKR 181mln increased from ~PKR 173mln (FY22: ~PKR 97mln).

Capitalization

The Company has a moderate leveraged capital structure primarily relying on short-term debt for managing its working capital needs. Its gearing ratio has

decreased from ~53.4% at the end of FY23 to ~50.5% at the end of FY24 due to increase in short-term borrowing. STB borrowing has increased to ~PKR 1,022mln from

~PKR 837mln during the same period.

|