Profile

Legal Structure

Bikiya

Industries (Pvt.) Limited (or the “Company”) was established in 2014

under the Directorship of Mr. Muhammad Saleem Bikiya.

Background

The

Company was established to manufacture tissue papers. The Company is among the

top five manufacturers of tissue paper with the brand name "TUX".

Operations

The

Company has its head office situated in Karachi. BIL deals in five products;

namely: i) Pop-up Tissue Box, ii) Toilet Roll, iii) Pop-up Mini Tissue, iv)

Hand Towel, and v) Party Pack. The Company imports raw materials from China,

Indonesia, and Malaysia and sells to northern, central, and southern regions of

Pakistan. All sales of the Company are direct sales and no dealers are involved

in the chain. As of Jun’24, about 55% of the customer base is located in the

central region for BIL, with 29% in the northern region and 16% in the southern

region. The top-selling product remains Tissue, contributing 95% to total

revenue, followed by Paper Cup (4%) and Ispaghol (1%).

Ownership

Ownership Structure

Bikiya

Industries (Pvt.) Limited is privately owned by three shareholders: Mr.

Muhammad Saleem Bikiy holds 80% shares, Mr. Usman Saleem Bikiya and Mr.

Muhammad Bilal 10% each. Mr. Muhammad Saleem Bikiya is the head of family with

Mr. Usman Saleem Bikiya and Mr. Muhammad Bilal are sons.

Stability

Mr. Saleem Bikiya demonstrates strong financial commitment during times of need. The group companies Bikiya Industries, Madiha International, and International Business Management support one another by providing long-term loans whenever required.

Business Acumen

The

directors associated with the Company have an extensive knowledge of the

business practices and Company processes, being associated with the Company for 11 years. The Major shareholder/Director Muhammad Saleem Bikiya has an overall

experience of 40 years. The other two shareholders/directors have an

accumulative experience of 11 years each.

Financial Strength

The

light asset and high turnover base model of business has provided strength to

the Company to establish its brand name amongst the leading importers of paper

and related products in the south market.

Governance

Board Structure

The Board of Directors (BoD) of the Company consists of three members, all of whom are also the principal owners of the organization. The Board is led by Mr. Saleem Bikiya, who serves as the Chairperson, overseeing the strategic direction and governance of the Company.

Members’ Profile

The majority owner/director Mr. Muhammad Saleem Bikiya has an

extensive experience of 40 years in paper industry while Mr Usman Saleem and Muhammad Bilal has 11 Years overall experience.

Board Effectiveness

At

Bikiya Industries (Pvt.) Limited,With a Board consisting of only three members, currently the Board has two active committes. 01) Audit committe 02) Human resources and remuneration committe, both of whichare Chaired by Mr. Usman. The Board has only three members and in

comparison, to established corporates, the governance model is weak and needs

improvement.

Financial Transparency

The

Company has appointed Shahid Hussain & Co chartered accountants as

auditors. The auditors have expressed an unqualified audit opinion on the

financial statements of Bikiya Industries Private Limited for the year ending

June 30, 2024. The firm is not QCR rated therefore there is room for

improvement in the corporate governance framework.

Management

Organizational Structure

Bikiya

Industries (Pvt.) Limited has developed a defined organizational structure considering the Company’s operational needs. The organizational

structure is divided into five main functions namely; 1) Sales & Marketing

2) Production 3)Purchase 4) Accounts & Finance, and 5) Collection &

Recovery.

Management Team

Mr.

Muhammad Saleem Bikiya is the CEO of the Company. He is experienced business person with an experience of more than 4 decades in the relevant field. He is working with the biggest groups in the paper industry including sinarmas group Indonesia known as Asia Pulp & Paper Mr. Farrukh Ejaz is the CFO

of the Company and provides external assistance to the Company over financial

matters.

Effectiveness

The

experience of the sponsors along with a professional management team has helped

the Company to streamline its operations. However, Management’s effectiveness

and efficiency can be ensured through the presence of management committees.

MIS

To

generate MIS and operational reports, the ERP software, SAP Business is being

used.

Control Environment

There is no internal audit, the absence of an internal audit department can leave an organization exposed to a variety of risks that could harm its financial standing, reputation, and overall operational effectiveness.

Business Risk

Industry Dynamics

Pakistan’s

packaging industry consists of four major segments, paper, plastic, tinplate

and glass. Paper and plastic segments occupy the major share in total market.

Despite, the economic slowdown caused by several issues, demand for the segment

remained almost consistent as it falls in the supply chain of various essential

products and industries. The segment’s direct costs consist largely of imported

raw materials. Chemical wood pulp is one of the main raw materials in the

production of paper packaging. Therefore, volatility in exchange rates and

international price trends has an impact on costs.The production levels of Paper over the last five years have experienced

a CAGR of ~7.2%. This reflects the stability of the segment as it makes up a

significant portion of overall Paper and board production. The production of

Paper increased in FY24 to ~366,267MT from ~311,675MT in FY23 with an increase

of ~17.6% YoY. (Source: PACRA Sector Study)

Relative Position

Bikiya

Industries (Pvt.) Limited maintains a strong market presence in Pakistan for

importing tissue paper and hold's a significant share in tissue paper product.

Amongst the larger players in the tissue paper industry and market size of ~

23000 tons/Annum, Bikiya falls under the top five convertors of tissue papers.

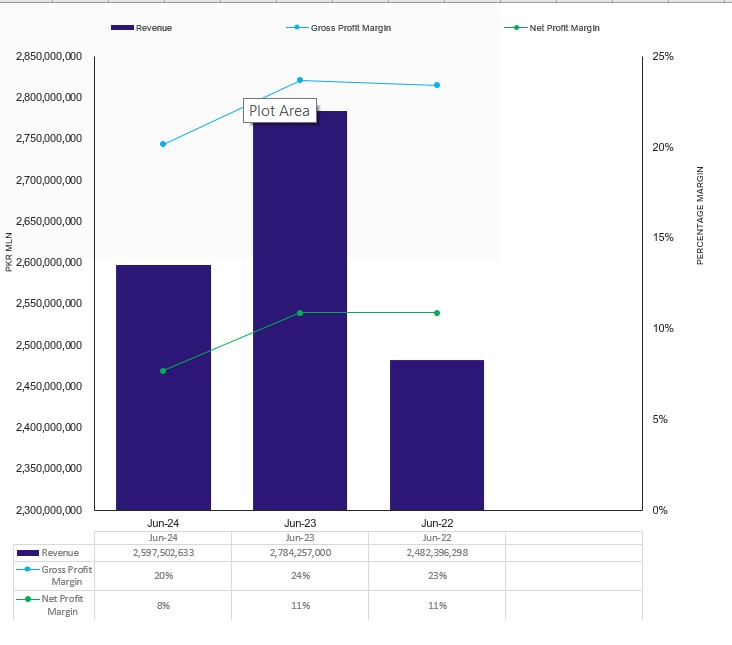

Revenues

The

Company’s top line shows an decreasing trend due to an decrease in sale price and decrease in prices of products has impacted demand . During FY24, the

Company generated a top line of ~PKR 2,598mln (FY23: ~PKR 2,784mln),

showing a decline of ~ 6.7% in revenue.

Margins

Tissue

paper rolls being used by the Company are 100% imported. So, to maintain the

margins, the Company passes on the cost to B2B consumers. In FY24, gross margin decreased as compared to FY23. The GP margin decreased

from ~23.7% in FY23 to ~20.2% in FY24 while the OP margin increased from ~10.6%

to ~11.8%. Consequently, the net profit margin also increased from ~5.9% to ~7.7%

during the same period. The bottom line of the Company clocked in at ~PKR 199mln

during FY24 decreased from ~PKR 303mln during FY23 (FY22: ~PKR 269mln).

Sustainability

The

Company is operating at ~84% capacity and has a plan to expand its operations

further to capture more market share. The brand name "TUX" has

already gotten renowned in the market and has established its foot marks.

Financial Risk

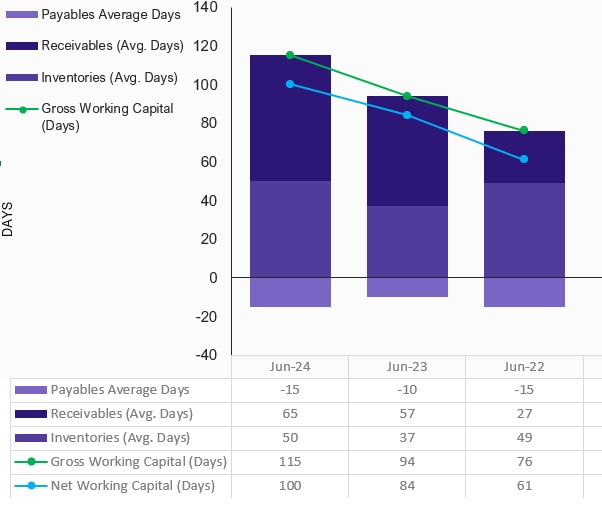

Working capital

Bikiya Industries (Pvt.)

Limited experienced a incline in inventory days, increasing from ~37 days at

end-Jun23 to ~50 days at end-Jun24. Inventory days are on the higher side

because the Company has imported raw materials in huge quantities due to the

rise in raw material prices and currency rate fluctuations. The trade

receivable days also increased significantly from ~57 days to ~65 days during

the same period. Likewise, the trade payable days increased from ~10 days at

the end of FY23 to ~15 days at the end of FY24. Consequently, the Company’s net

working capital days increased significantly to ~100 days at the end of FY24

from ~84 days at the end of FY23.

Coverages

In

FY24, the Company’s EBITDA stood at ~PKR 213mln decreasing from ~PKR 448mln in

FY23. As a result in FY24, the Company’s FCFOs stood at ~PKR 343mln decreasing

from ~PKR 577mln in FY23; however, this is still a good coverage level for the

Company.

Capitalization

The

Company has a low-leveraged capital structure. Short-term debt is primarily linked to expansion activities. As a result, the gearing ratio rose from approximately 3.3% at the end of FY23 to around 14.8% by the end of FY24. This increase is attributed to a rise in short-term borrowings (STB), which grew from 0 in FY23 to 185 million during FY24.

|