Profile

Legal Structure

Imperium

Hospitality (Private) Limited (“IHPL” or “the Company”) is a private limited

entity incorporated in Pakistan on July 12, 2016, under the Companies

Ordinance, 1984 (now the Companies Act, 2017). It operates as a subsidiary of

the Monnoo Group, with a vision to pioneer a state-of-the-art corporate

infrastructure and redefine commercial real estate and business spaces. The

Company’s registered office is located in Lahore, Pakistan.

Background

Following

Partition, the Monnoo family relocated to East Pakistan and later expanded into

the textile industry, establishing five spinning mills—three in West Pakistan

and two in East Pakistan. Over the decades, the Monnoo Group has emerged as a

leading industrial conglomerate, contributing significantly to Pakistan’s

economic growth. The Group’s diversified portfolio includes twelve textile

units, agricultural farms, and research units specializing in agricultural

products. Monnoo Group has gained global recognition for its expertise in

textile and agriculture sectors. In textiles, its product range includes yarns,

ecru yarn, fancy/novelty yarns, mélange yarns, and sewing threads, whereas its

agricultural operations focus on tissue culture, orchards, and farm

development.

Operations

Imperium Hospitality (Private) Limited is primarily engaged in business as builders and developers, focusing on the development, management, and operation of real estate ventures.

Currently, the

Company is focused on the development and construction of Imperium Tower in

Gulberg, Lahore. This architecturally modern twin-tower project consists of

four basement levels, a ground floor, and eighteen additional stories. Designed

to set new benchmarks in commercial real estate, Imperium Tower aims to combine

luxury, functionality, and modern aesthetics.

Ownership

Ownership Structure

Imperium Hospitality (Private) Limited is wholly

owned by the sponsoring family, with M/s Kaisar Shahzada (Private) Limited

holding a majority stake of 36%. The remaining ownership is equally distributed

among Mr. Danish Kaisar Monnoo, Mr. Sheraz Jehangir Monnoo, and Mr. Shahbaz

Alam Monnoo, each holding 21% of the shares.

Stability

The Company's ownership structure appears stable, with no anticipated

changes in shareholding in the near future. The Monnoo Group, through its

investment arm, Kaisar Shahzada (Private) Limited, retains a significant stake,

ensuring continuity and strategic direction. However, further strengthening of

the structure through a well-defined and streamlined shareholding arrangement

among family members, along with a formalized succession plan, would enhance

long-term stability. Proper documentation of the succession framework would

also provide greater clarity for practical implementation and future leadership

transitions.

Business Acumen

The Monnoo family, the principal sponsors of the Group, is widely

recognized for its strong business acumen. Having operated in Pakistan for

several decades, the Group has successfully expanded into multiple industries,

including textiles, real estate, and agriculture. Its extensive industry

expertise, strategic vision, and ability to adapt to evolving market dynamics

have reinforced its position as a prominent business conglomerate.

Financial Strength

The Monnoo Group’s diversified investment portfolio, spanning textile,

power, real estate, and agriculture, reflects its strong financial standing.

With multiple entities under its umbrella, the Group is well-positioned to

provide financial support to Imperium Hospitality (Private) Limited, should the

need arise. Its diversified asset base and stable revenue streams further

reinforce the sponsors’ ability to back the Company’s long-term growth and

sustainability.

Governance

Board Structure

The Board of Imperium Hospitality (Private) Limited

consists of three members, including Chief Executive Officer & Director, Mr. Sheraz

Jehangir Monnoo, and two non-executive directors, Mr. Danish Kaisar Monnoo and

Mr. Shahbaz Alam Monnoo. The Company does not have any independent directors,

and the board is primarily family-dominated. All members have been associated

with the board for over two decades, ensuring continuity and strategic

alignment with the Group’s long-term vision.

Members’ Profile

The board members are

seasoned professionals with extensive industry experience. Mr. Sheraz Jehangir

Monnoo, the CEO & Director of the Company, has over twenty years of expertise in the sector. As the

driving force behind the development of Imperium Tower, he leads with a visionary

approach and also holds director positions in other Monnoo Group companies. His

leadership, coupled with the business acumen of the other board members,

reinforces the Company’s strategic direction and operational efficiency.

Board Effectiveness

The Company does not have

any formal board committees, and all board members concurrently hold director

positions in other Group entities. This structure, while ensuring experienced

leadership, limits the scope for impartial oversight and enhanced corporate

governance. Establishing dedicated board committees, including audit and risk

management committees, could improve governance mechanisms and decision-making

processes.

Financial Transparency

The Company’s financial statements are audited by

M/S Mushtaq & Co., Chartered Accountants, a State Bank of Pakistan (SBP)

Category ‘B’ audit firm. For the year ended June 30, 2024, the auditors issued

an unqualified audit opinion, affirming that the financial statements present a

true and fair view of the Company’s financial position in accordance with

applicable reporting standards.

Management

Organizational Structure

Imperium Hospitality

(Private) Limited follows a simplified organizational structure, designed to

streamline operations and enhance managerial efficiency. The functions

reporting to the CEO are categorized into five key areas: Operations, Finance,

Sales, Consultants, and In-House Engineers. Each of these functions is further

divided into specialized sub-units, ensuring a structured approach to managing

the Company’s diverse activities. The entire operational framework falls under

the direct oversight of the CEO, facilitating a centralized decision-making process.

Management Team

The Company’s leadership is

spearheaded by Mr. Sheraz Jehangir Monnoo, who has been associated with the

Monnoo Group since its inception. Holding a bachelor’s degree from the

University of Boston, USA, he brings a strategic vision and deep industry expertise

to the organization. Supporting him is a team of qualified professionals, each

bringing relevant industry experience. A key member of this team is Mr.

Muhammad Shahbaz, the Chief Financial Officer (CFO), who is a Chartered

Accountant and has been associated with Monnoo Group for several years. His

financial expertise plays a crucial role in ensuring the Company’s fiscal

discipline and long-term financial sustainability.

Effectiveness

Backed by an experienced

management team, IHPL continues to strengthen its position and expand its

footprint in Pakistan’s real estate industry. The well-defined functional roles

within the Company ensure that operational objectives are effectively aligned

with its strategic vision. By leveraging its expertise, the management team is

driving growth, operational efficiency, and business expansion.

MIS

The Company has

deployed an Oracle-based ERP solution, which integrates multiple operational

modules to track daily and monthly reports. This technology-driven system

enables real-time monitoring and data-driven decision-making, ensuring that

management maintains a high level of operational oversight and efficiency.

Control Environment

To

maintain operational efficiency and strong internal controls, the Company has

implemented a robust oversight mechanism. It has an in-house team of engineers,

supplemented by an outsourced design development team, project managers,

construction consultants, and contractors. This integrated framework allows the

Company to identify, assess, and manage risks associated with the construction

and development of high-rise buildings. Through this proactive risk management

approach, IHPL ensures that all projects are executed with precision,

compliance, and quality assurance.

Business Risk

Industry Dynamics

Pakistan’s

real estate sector operates in a rapidly evolving landscape, influenced by

demographic shifts, economic policies, technological advancements, and

sustainability trends. While external financing risks and policy volatility

remain key challenges, the government’s supportive initiatives and the

industry's adaptability continue to drive growth and transformation. Recent

economic indicators present a mixed outlook for the sector. Inflation has

significantly declined, reaching 1.5% in February 2025, the lowest in nearly a

decade. This deflationary trend has prompted the central bank to implement

consecutive rate cuts, reducing the key policy rate to 12%, which is expected

to stimulate real estate activity. However, external financing concerns

persist, with over $22 billion in external debt repayments due in 2025,

highlighting the need for fiscal prudence and structural reforms to sustain

economic stability.

Relative Position

As a new entrant in the

real estate sector, Imperium Hospitality (Private) Limited (IHPL) is actively

establishing its brand identity, with ‘Imperium Tower’ serving as its flagship

project. Despite being in the early stages, the Company has made notable progress,

garnering strong customer interest. A testament to this momentum is the

successful sale of Block A of Imperium Tower to M/S Fauji Fertilizer Company

Limited (FFC), a significant milestone in strengthening IHPL’s market

positioning. In terms of competition, Tricon Tower and Askari Tower are key

players in the landscape. However, it is noteworthy that both towers currently

have no vacant space available.

Revenues

The

successful completion and handover of Block A to FFC granted them full

ownership of all associated rights and interests, generating approximately PKR

3.7 billion in revenue for FY24. Looking ahead, rental income from Tower B is

expected to contribute substantially to the Company’s revenue. The contractual

revenue stream for Tower B has not commenced yet, but IHPL plans to lease a

significant portion of the space to IT firms and multinational corporations.

Discussions are ongoing with potential tenants, including a French company, a technology

firm, and an entity planning to establish a modern wellness center. Currently,

two to three lease agreements are in the final negotiation stages.

Margins

Since the rental operations of Tower B have yet

to commence, IHPL’s core business margins are not yet fully materialized.

However, profitability is expected to improve significantly upon the project’s

completion and leasing activities, contributing to the Company’s long-term

financial stability.

Sustainability

Block B is in the final stages of completion,

with meticulous finishing work underway. According to the latest management

update, it is expected to be fully ready for handover to prospective tenants at

the start of the new fiscal year. The resulting revenue inflows will contribute

significantly to the company's financial stability and long-term

sustainability, reinforcing its growth and operational resilience.

Financial Risk

Working capital

Imperium

Hospitality (Private) Limited manages its working capital requirements through

a combination of internally generated funds, interest-free loans from sponsors,

and long-term borrowings (LTBs). As of FY24, the total quantum of LTBs stood at

PKR 399 million, representing 80% of the total debt portfolio. This approach

ensures financial flexibility while minimizing reliance on external commercial

financing.

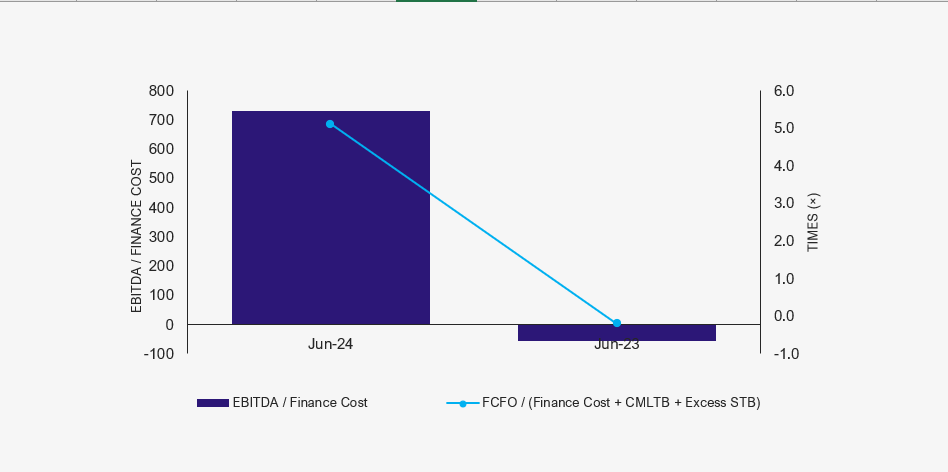

Coverages

During FY24, the

Company’s Funds from Operations (FCFO) were recorded at approximately PKR 508

million. With anticipated revenue growth in the coming years, EBITDA is

expected to increase at a stable rate, strengthening the Company’s operational

cash flows. Additionally, with finance costs remaining stagnant and improved

FCFO, the Company is positioned to achieve a stronger debt coverage profile

over time.

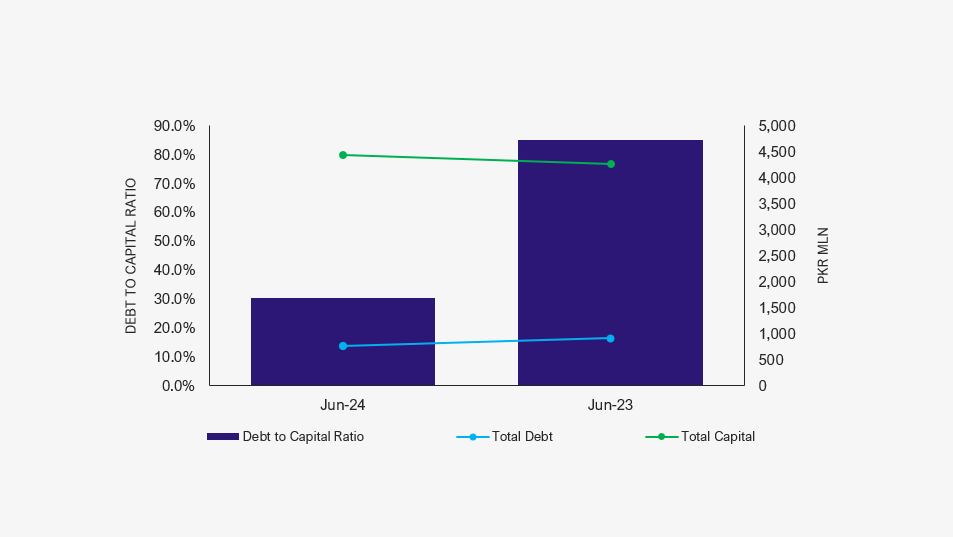

Capitalization

IHPL

maintains a leveraged capital structure, though its leverage ratio has seen a

substantial decline in recent years. As of FY24, the leverage ratio stood at

30.3%, a significant improvement from 85% in FY23 and 66.6% in FY22. This

decline reflects the Company’s efforts to strengthen its equity base, which

reached PKR 2,159 million, while total borrowings stood at PKR 497 million. The

improving capitalization profile is indicative of IHPL’s strategic financial

management, ensuring a sustainable balance between debt and equity.

|