Profile

Legal Structure

H.A.R Fibres (Private) Limited (‘H.A.R Fibres’ or ‘the Company’) was incorporated in Jun-18 under the Companies Act, 2017.

Background

The Company

is a venture

of the Shahid Family that holds interests in yarn trading in

Faisalabad. The Company is a part of H.A.R Group, with H.A.R Textile

Mills (Pvt.) Limited is the other group company, which has been

operational since 1958.

Operations

H.A.R Fibres specializes in yarn manufacturing and distribution, headquartered near Faisalabad's Clock Tower. Its manufacturing plant is located in Mohalla

Mughalpura, Naya Lahore, and houses approximately 20,000 spindles, ensuring operational efficiency and accessibility to key resources and markets.

Ownership

Ownership Structure

Mr. Shahid Mehmood Sheikh possesses ~40% stake in the Company. The remaining ownership is distributed among his sons: Mr. Haroon

Shahid (~20%), Mr. Faizan Shahid (~20%), and Mr. Adan Shahid (~20%).

Stability

The Company inherits the technical and business expertise from the first generation to the second generation of the Shahid family, combining the guidance and

knowledge of the founders with the new generation. However, a formal succession plan requires to be documented.

Business Acumen

The sponsoring family is interested in textiles and investing in the real estate sector. The sponsors have vast experience and knowledge of various aspects of the textile value chain and have witnessed many businesses over a span of more than four decades.

Financial Strength

Sponsors hold considerable financial footing to support the Company, if needs be, going forward.

Governance

Board Structure

The four-member Board of Directors (BoD) is dominated by the Sponsoring family and comprises an Executive Director and three Non-Executive Directors. The BoD's decision-making process can be strengthened by the inclusion of an Independent director.

Members’ Profile

Mr. Shahid Mehmood

Sheikh, the BoDs Chairman and Chief Executive Officer (CEO), has been in the yarn trading business for the last 46 years and enjoys a good reputation in the business community. Mr. Haroon Shahid, Non-Executive Director, has an overall experience of more than two decades in yarn manufacturing and trading and has been associated with the Company for 5 years. All other Board members are qualified in different disciplines and have ample experience in textile and other industries.

Board Effectiveness

The absence of a structured system for recording BoD minutes

highlights a need for improvement in the overall governance framework. Moreover, there is a lack of BoD committees to facilitate the decision-making process.

Financial Transparency

Zahid Jamil & Co., the Company's external auditors, is a QCR-rated firm with a listing under category "B" by the State Bank of Pakistan. They have provided an unqualified opinion on the Company's financial statements for FY24.

Management

Organizational Structure

The Company's organizational framework comprises three primary departments: i) Finance, Admin & Marketing, ii) Purchase, and iii)

Production. Each department is headed by a respective head, who reports to the Executive Directors, who reports to the CEO. The CEO makes the pertinent decisions and is considered the man at the last mile.

Management Team

Mr. Shahid Mehmood Sheikh holds the position of CEO. He has been in the yarn trading business for the last 46 years and enjoys a good reputation in the business community. Mr. Ejaz Ali, the CFO, has more than three decades of experience and has been associated with the Company for five years. They are assisted by a team of professionals.

Effectiveness

The Company has no management committees. The Sponsor's close involvement in day-to-day business affairs bodes well for the effectiveness of the

Company.

MIS

The Company has built an in-house oracle to cater to the business needs. The senior management monitors the business performance through certain Key MIS

reports.

Control Environment

Production is completely order driven, and the QC department conducts a rigorous quality check on the end product. The Company has obtained

ISO 9001 certification.

Business Risk

Industry Dynamics

Pakistan’s spinning sector comprises ~368 spinning units

consisting of ~13.4mln spindles. Cotton production increased by ~70.9% YoY in

FY24, recorded at ~8.4mln bales (FY23: ~4.9mln bales) owing to an increase in

the area under cultivation, a better quality of pest-resilient seeds, favorable

weather conditions, and attractive fixation of the intervention price of cotton.

As a result, cotton imports drop significantly to ~1.2mln bales (FY23: ~4mln bales).

The spinning sector in Pakistan is likely to face challenges in FY25 due to rising

costs, high energy tariffs, and limited competitiveness. Despite economic

recovery, profitability margins are under pressure, and reliance on imports is

expected to grow.

Relative Position

With its operational spindle count of 20,000, H.A.R Fibers is categorized as a

relatively small player in Pakistan's spinning sector.

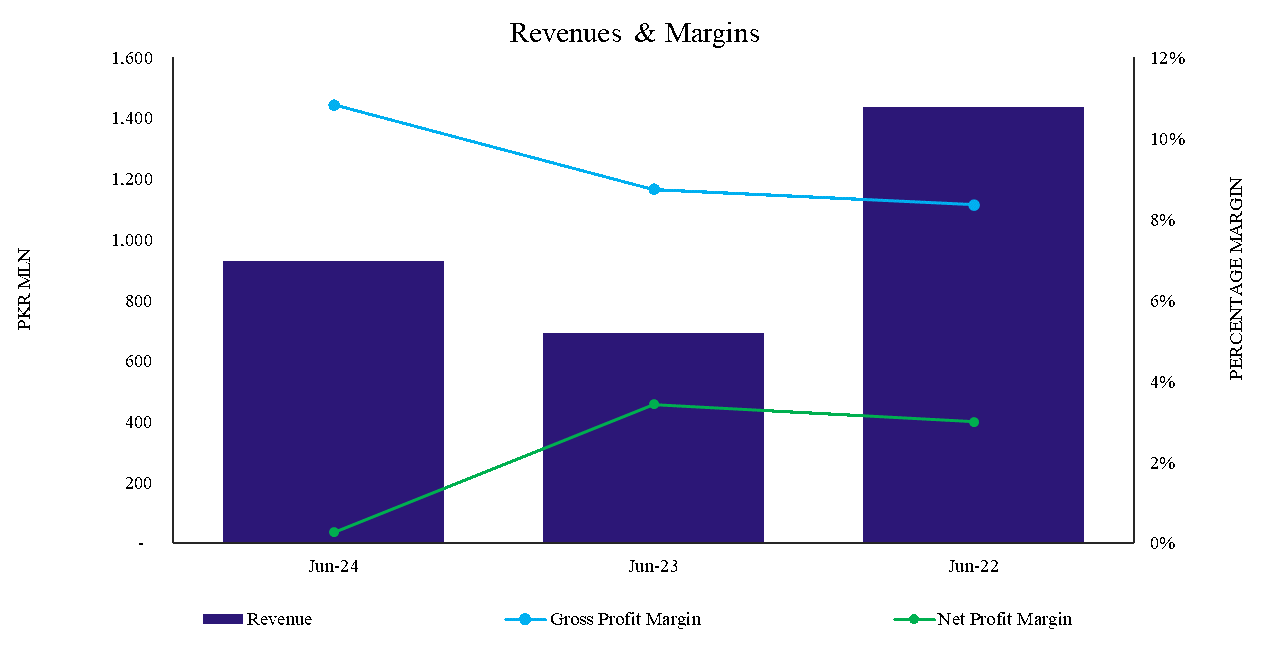

Revenues

During FY24, the Company witnessed a value-driven uptick

of 34% in its revenue, reported at ~PKR 930mln (FY23: ~PKR 693mln). The Company

lacks a brand-specific customer base and distributes its entire output in

Faisalabad through sales brokers. H.A.R Fibres faces a notable customer

concentration risk, relying solely on local yarn sales. Going forward, revenue is expected to increase due to the country's improved economic conditions.

Margins

During FY24, the cost of goods sold increased in line with an increase in revenue and was reported at ~PKR 830mln (FY23: ~PKR 632mln), resulting in a gross profit of ~PKR

101mln (FY23: ~PKR 61mln) with gross margin reported at ~10.8% (FY23: ~8.7%). Net

profit was reported at ~PKR 3mln (FY23: ~PKR 24mln) due to tax expense of ~PKR

37mln (FY23: ~PKR 2mln), resulting in a net profit margin of ~0.3% (FY23: ~3.4%). Going forward, margins are expected to improve due to a decrease in policy rate and the Company's gradual shift towards solar energy.

Sustainability

Going forward, in line with the improving business

environment, the Company plans to start a BMR, which will add 1,000

rotors to existing capacity. The total cost of CAPEX is estimated to be ~PKR

100mln, which will entirely be funded from equity. BMR is expected to bring in

efficiency gains, lower costs per spindle, and consequently improve

margins. However, timley and successful materialization of the same remain imperative.

Financial Risk

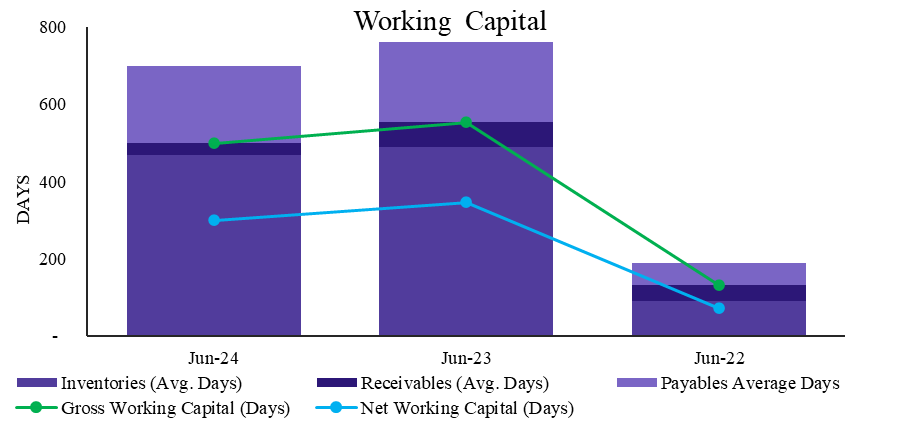

Working capital

As of FY24, increased demand reduced inventory turnover

days to ~467 days (FY23: ~488 days). Trade receivable days reduced to ~31 days

(FY23: ~65 days), demonstrating the Company’s ability to collect customer payments. Trade payables days reduced slightly to ~199 days (FY23: ~207 days), demonstrating a moderate position of the Company to negotiate credit from suppliers. The

combined impact of decreased inventory days, trade receivable days, and trade

payable days resulted in a net working capital cycle of ~300 days (FY23: ~346

days). The borrowing cushion of the Company remains moderate.

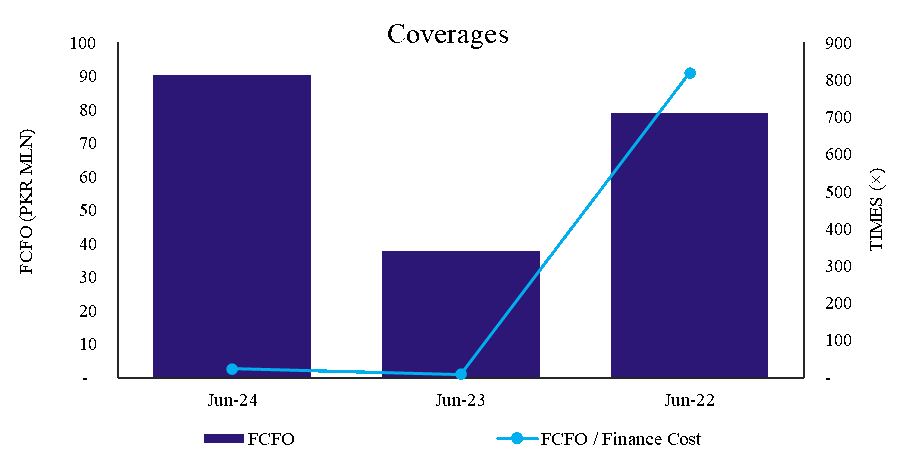

Coverages

As of FY24, the Company’s Free Cash Flow from Operations

(FCFO) was reported at ~PKR 90mln (FY23: ~PKR 38mln), a substantial uptick of ~137% due to

an increase in profit before tax reported at ~PKR 40mln (FY23: ~26mln). Finance cost

remained stable at ~PKR 4mln (FY23: ~PKR 4mln). The increased FCFO with

stable finance cost resulted in an FCFO/Finance Cost coverage of ~23.1x (FY23: ~8.4x). Going forward, coverages are expected to improve with declining finance costs.

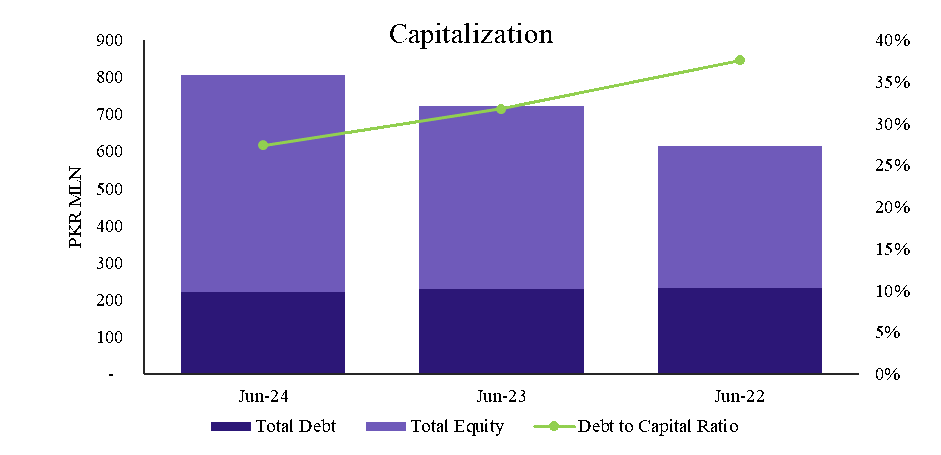

Capitalization

As of FY24, the Company reported a decline in total

borrowings by ~3.5%, reported at ~PKR 221mln (FY23: ~PKR 229mln), primarily due

to a decrease in long-term borrowings reported at ~PKR 40mln (FY23: ~PKR 60mln).

Shareholders’ equity increased by ~19%, reported at ~PKR 585mln (FY23: ~PKR

492mln), resulting in an improvement in the Company’s leverage reported at ~27.4%

(FY23: ~31.8%).

|