Profile

Legal Structure

Warble (Pvt) Limited ('the Company’) is a private limited company incorporated in 1995 under the Companies Ordinance 1984 (now the Companies Act 2017).

Background

Allahdin Group of Companies (‘the Group') is among the leading players in the pesticide sector. The Company was the second company set up by the Group. While the sponsoring family primarily focused on the construction business, one of the siblings possessed extensive experience in the agriculture industry, bringing valuable expertise.

Operations

The Company's activities involve imports, formulations, manufacturing & marketing of all kinds of pesticides (Insecticides, Herbicides, Fungicides, Insect Growth Regulators), fertilizers and micronutrients (liquid & granules), plant growth regulators, seeds of different field crops & vegetables, etc. The Company's head office is in Lahore, and the formulation facility is at Industrial Estate Multan, which is equipped with Chinese machinery and technology. The Company operates and sells its products through its franchise network titled

Agro-Mart.

Ownership

Ownership Structure

The Company's ownership transitioned to the new generation. Mr. Masood ur Rehman possesses a majority shareholding of ~47%, followed by Mr. Zain Ifterkhar with ~44%, Mr. Atta ur Rehman with ~7%, and Ms. Ghazala Ghazni holds ~2% stake of the Company.

Stability

Although there is no formal succession plan, the ownership of the Company rests among the family members, with the next generation now having control over the respective companies their predecessors had control over.

Business Acumen

The Company has a strong history of succeeding in agriculture. They have created synergies throughout Pakistan by using cutting-edge technology and providing one-of-a-kind services. The Group is equipped with people with vision, wisdom, and unique skills.

Financial Strength

The Group's history dates back to the 1990s and holds vested business interests in agriculture, bottling, and the pharmaceutical industry. The Group will support the Company if need be.

Governance

Board Structure

The control of the Company vests with a three-member Board dominated by the sponsoring family with two Executive Directors and one Non-Executive Director.

Members’ Profile

All members have been with the organization for a long time. Mr. Masood possesses significant knowledge, expertise, and skill set and has over a decade of experience in the pesticide sector. He is the Chairman & Chief Executive of the Company.

Board Effectiveness

The Board meets frequently, and minutes are documented as per the requirement. However, no Board committees exist to assist the Company's Board.

Financial Transparency

The External Auditors of the Company, M/S. HLB Ijaz Tabussum & Co., Chartered Accountants, a "B" category QCR-rated firm, expressed an unqualified opinion on financial statements for the period ended FY24.

Management

Organizational Structure

Business operations are divided into four key functions, namely: (i) Sales & Marketing, (ii) Finance, (iii) HR & IT, and (iv) Taxation & Accounts. The reporting lines converge to the CEO, who is the man at the last mile, i.e., the key decision maker.

Management Team

Mr. Masood Ur Rehman is the CEO of the Company and possesses the required knowledge, expertise, and skillset. He has been with the business for a long time and is assisted by a team of professionals.

Effectiveness

Management meetings are conducted as needed, with senior management contributing their insights to the decision-making process. Ch. Iftikhar Nazir serves as the ultimate authority in all decision-making matters. The Company does not have any formalized management committees in place.

MIS

The Company has built an in-house ERP system, incorporating required modules like inventory, sales & marketing, finance, procurement, HR, etc. It generates reports on a daily, weekly, and monthly basis.

Control Environment

The frequent meetings at the management level demonstrate that the Company's monitoring and evaluating systems are appropriate. The monthly and quarterly MIS reports of the Company include detailed segments and product performance data is evaluated monthly by senior management.

Business Risk

Industry Dynamics

The agricultural sector plays a pivotal role in Pakistan's economy, contributing ~25% to the GDP and serving as a crucial source of raw materials for various industries. The industry heavily relies on pesticides to enhance crop protection and cultivation practices (Agro Chemicals). The pesticide sector significantly depends on imports as ~85-90% of raw material is imported from China. In FY23, the pesticide industry's estimated value stood at ~PKR 103.7bln, marking a YoY increase of ~5.4%. This growth is attributed to the overall expansion of the crops sector and the subsequent rise in demand. Additionally, increased prices have further contributed to this upward trend. In FY23, pesticide imports reached around ~PKR 36bln, reflecting a ~19% YoY increase. Among these imports, insecticides accounted for the majority. The sector's overall leveraging remains adequate, with stable coverage ratios. Going forward, the sector's overall outlook is expected to remain stable

Relative Position

Allah Din Group overall holds a strong market position and brand image in the industry.

Revenues

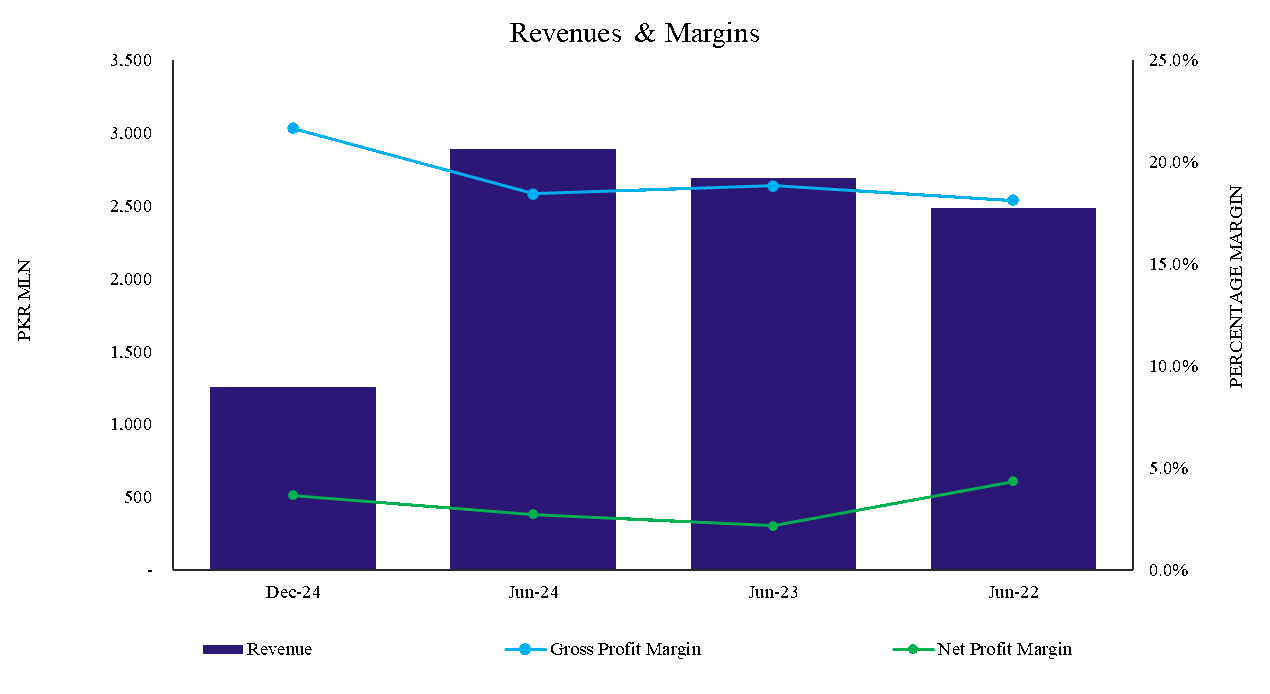

The Company maintains a healthy topline reporting at ~PKR 2,887mln

in FY24, witnessing growth of ~7.2% on YoY (6MFY25: ~PKR 1,259mln, FY23: ~PKR

2,692mln, FY22: PKR 2,495mln). The Company maintains a well-integrated network of

over 750 franchises nationwide. Improvement in revenue was majorly attributed to

price hike of finished products. The large product base in different segments enables the diversification of revenue streams through regular product launches.

Margins

During FY24, the gross profit margin of the Company stood at ~18.5%

(FY23: ~18.9%) experienced a slight decline. This decline can be attributed to a higher

percentage increase in the cost of goods sold when compared to the sales. This trend of high

costs followed when the Company witnessed a slight increment in its operating costs,

reducing its profit margin, which stood at ~9.3% in FY24 (FY23: ~9.7%). This trickle-down

effect impacted the net profit margins of the Company, which was reported at ~2.7% in

FY24 (FY23: ~2.2%) owing to lower finance costs incurred during the period under review.

Sustainability

Going forward, the management will focus on sustaining its cost leadership and performance uptrend. The Company is securing its business by registering its farmers and providing them with pesticides and, in return, purchasing their crops. The idea was implemented in the cotton and wheat segments. Furthermore, management plans to maintain a real estate business through a group company, Warble Constructions, to diversify its revenue stream.

Financial Risk

Working capital

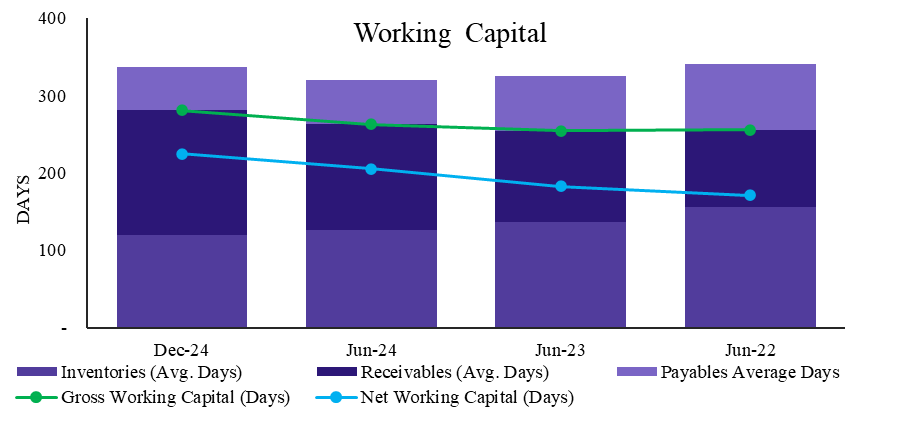

As of FY24, the Company reported an increase of ~22 days in its net working capital days, reporting at ~205 days (FY23: ~183 days), raising concerns about the increased duration in which the Company's money is tied in its net working capital. Evaluating the components, it was observed that the average days in inventory decreased by ~11 days to ~126 days (FY23: ~137 days), reflecting the improved conversion of inventory into sales. Furthermore, the average days in trade payables also reported a decline of ~13 days to ~58 days (FY23: ~71 days). This decline reflects quicker payment to suppliers, which raises cash flow concerns due to quicker outflow. Lastly, average days in trade receivables rose by ~20 days to ~137 days (FY23: ~117 days), signifying an extended period for collecting cash from sales reflecting inefficiency. Overall, the increase in net working capital days raises working capital and cash flow concerns, and going forward, the Company needs to implement strategies to improve its receivable collection and overall cash flows.

Coverages

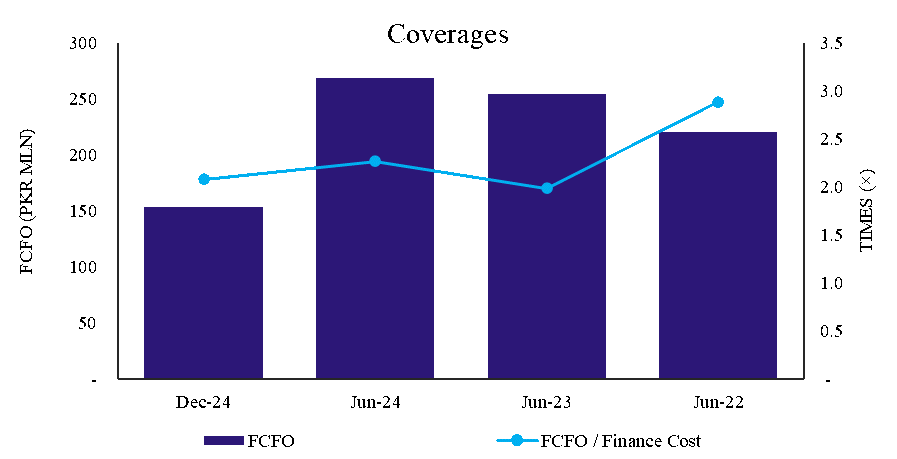

Warble maintains a satisfactory liquidity profile,

primarily supported by the Free Cash Flow from Operations (FCFO), which stood at ~PKR

268mln (FY23: ~PKR 254mln). Further, the Company faced a slightly reduced impact on

its liquid coverage ratio due to reduced finance costs reported at ~PKR 126mln in FY24

(FY23: ~PKR 130mln), yielding in the interest coverage ratio (FCFO / Finance Cost), which

stood at 2.3x in FY24 compared to 2.0x in FY23, the Company consistently exhibits the

capability to cover its interest expenses sufficiently. Looking ahead, the expectation of

reduced policy rates may potentially lead to reduced finance costs.

Capitalization

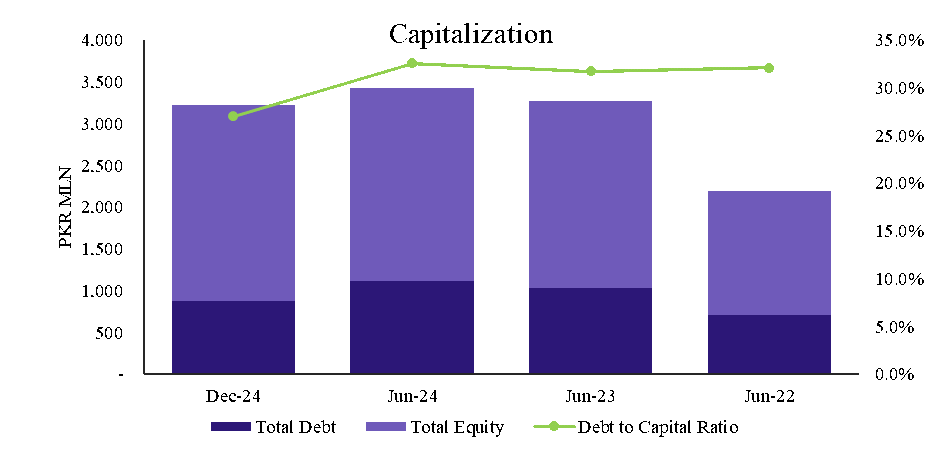

Warble maintains a moderately leveraged capital structure with

a leverage ratio of 32.6% in FY24 (FY23: ~31.7%). The ratio has increased slightly due to increased total borrowings reported at ~PKR 1,115mln (FY23: ~PKR 1,037mln). At the same time, the equity grew and stands at ~PKR 2,309mln (FY23: ~PKR 2,231mln) due to profit accumulation. As of 6MFY25, the leverage ratio was reported at ~27.1%, with total borrowings declining to ~PKR 873mln and equity rising to ~PKR 2,355mln.

|