Profile

Legal Structure

Siddiqsons Tin Plate Limited ("STPL" or the "Company"), incorporated as a public listed company in 1996, is listed on the Pakistan Stock Exchange (PSX). Its registered office is in Karachi, with production facilities located in Karachi, Sindh, and Windhur, Balochistan.

Background

The Company, established in collaboration with Sollac of France and Mitsubishi Corporation of Japan, commenced commercial operations in May 1999 and added a canning facility in Malir, Karachi, in 2009.

Operations

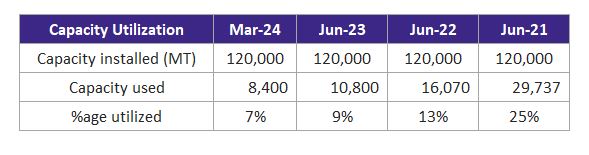

STPL manufactures and sells Electrolytic Tin Plates (ETP), cans, and other steel products, operating under a B2B model. Its tin plate plant has an installed capacity of 120,000 MT per annum, while the canning facility produces up to 4,015,000 cans annually.

Ownership

Ownership Structure

The Rafi Family holds a controlling ~55% stake in the Company directly and ~15% indirectly through Siddiqsons Limited, which is fully owned by the family. The remaining 30% shares are held by other individuals.

Stability

The Rafi Family has held controlling shareholding in the Company since its inception, though no formal succession plan is in place.

Business Acumen

The sponsor family has strong working knowledge as they are operating in the industry since 1996 and are the only manufacturer of tin plate in Pakistan. The Company's founder, Mr. Tariq Rafi, has been associated with the textile business since 1959 and carries vast knowledge and experience of the industry.

Financial Strength

The Rafi Family, with a diverse portfolio in banking, energy, real estate, and metals, has a proven capacity to provide timely financial support to the Company. Their strong financial strength is evident through past assistance, including a rights issue to fund Capex and support for the recent expansion project. Continued support is expected if needed. The equity of Siddiqsons Limited was reported at PKR 16.5bln, with a profit after tax (PAT) of PKR 1.375bln.

Governance

Board Structure

The Company's seven-member Board includes two independent directors, three non-executive directors, and two executive directors (including the CEO). Chaired by Mr. Tariq Rafi, all non-independent directors represent the Rafi Family.

Members’ Profile

Mr. Tariq Rafi, Chairman of the Board, is also serving his responsibilities as the director on the Board of MCB Bank Limited, Centrak Depository Company, Siddiqsons Limited, Siddiqsons Energy Limited, & Canvas Company of Pakistan (Pvt) Limited. Mr. Rafi joinged STPL since the inception of the Company. Mr. Munir Qureshi, Executive Director, is an engineer with a graduate degree in public administration from Harvard University. A certified director under the Code of Corporate Governance, he has been a member of STPL's Board since 2015. Mr.Ibrahim Shamsi, non-executive director, has vast experience of modern management and effective control management. He is the CEO of Aladin Water and Amusement Park, Karachi and Joyland, Lahore. He is also serving as the director of Adam Jee Insurance Company Limited, the largest insurance Company of Pakistan. Ms. Alia Sajjad, a non-executive director, joined the Board in 2018. She is the Executive Director of Siddiqsons Limited and serves as COO of Triple Tree Associates, overseeing the company's finance, marketing, and operational affairs. Mr. Abdul Wahab, Independent director, joined the Board in 2018 and has experience in business management. Mr. Ashraf Mahmood Wathra, an independent director since 2018, brings 35 years of experience in commercial, corporate, and investment banking. He has represented Pakistan at various international forums and held leadership roles in national and international banks prior to joining the State Bank of Pakistan.

Board Effectiveness

The Board met four times during FY23 with most of the directors attending four or more meetings. The Board has established four sub-committees, i) Audit Committee, ii) Human Resource & Remuneration Committee and iii) Technical Committee. Both committees are chaired by non-executive directors.

Financial Transparency

Yousuf Adil, Chartered Accountants, serve as the Company's external auditors. They issued an unqualified opinion on the financial statements for the year ended June 30, 2023. Their limited review report for the half-year ended December 31, 2023, includes an emphasis of matter paragraph highlighting the contingency related to the New Metallurgy Hi-Tech Group Co. Limited case. The Board has established an internal audit department that reports directly to the Board Audit Committee.

Management

Organizational Structure

The Company has a well-defined management structure with functional departments and clear responsibilities.

Management Team

The management team is led by Mr. Naeem ul Hasnain Mirza, the CEO of the Company. An Electrical Engineer, Mr. Naeem began his career with STPL in 1999 and has served in various management roles across operational areas during his 23-year tenure. He was appointed CEO of Siddiqsons Tin Plate in 2022.

Effectiveness

The Company has established two management committees to coordinate its operations, namely, i) Technical Committee, and ii) Procurement Committee.

Technical committee is the apex management committee. The committees meet on requirement basis. Technical Management Team, including the CEO, Director Commercial, CFO, GM Commercial, and GM Marketing.

MIS

The Company has implemented Sidat Hyder Financials suit to manage the financial information needs of management. Further, the Company has implemented in house developed softwares to manage stock and stores. The management is also running a separate payroll software to process payroll data.

Control Environment

The management has a strong control environment. There exists an established internal audit function which includes three members comprising the Head of Internal Audit. The head of Internal audit reports directly to the audit committee.

Business Risk

Industry Dynamics

The industry can be divided into two segments, namely, i) Local manufacturers, and ii) Commercial Importers of ETP. Siddiqsons Tin Plate is the

only tin plate manufacturer in Pakistan, while there are several commercial importers of ETP. The total market size of Tin plate coil was declined significantly during CY23 and onwards on the back of reduction in sales due to tax exemptions in the FATA/PATA region and increased usage of Galvalume in food packaging instead of tinplates. As per management representation, these challenges have led to a decline in production utilization from 25% to 7% over the last three years. The implementation of anti-dumping duties on Galvalume and the removal of tax exemptions in FATA/PATA are expected to significantly strengthen local demand for tinplates

Capacity Utilization

Relative Position

The Company is the only tin plate manufacturer in Pakistan and as per management representation holds an adequate share of the total market. The other competitors are various small commercial importers of tin plate.

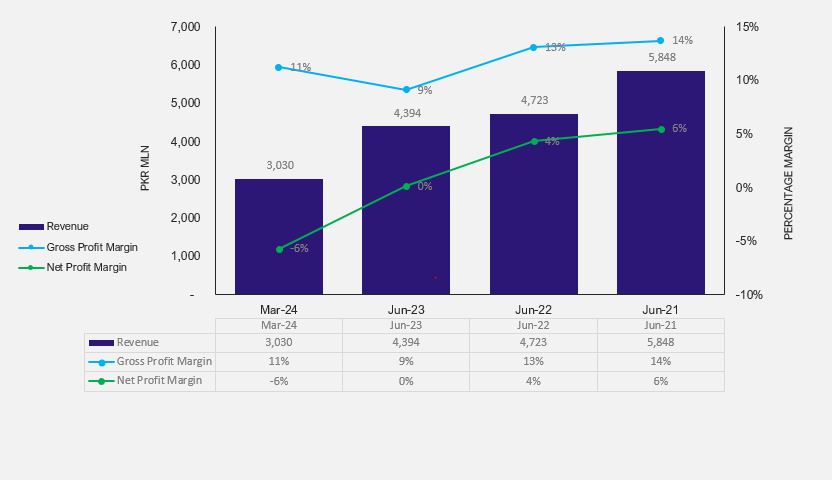

Revenues

During the 9MFY24 period ending March 2024, the Company’s sales revenue declined by 16%, reaching PKR 3,030mln. The cost of sales also saw a decline of 12%. This decline was primarily due to negative sales volume caused by raw material shortages, unfavorable market conditions such as the availability of inexpensive tinplate due to misuse of sales tax exemptions in the FATA/PATA region, and the use of Galvalume steel in food packaging despite health concerns. Additionally, a significant 80% increase in finance costs compared to the same period last year continued to impact profitability. The Company reported a loss after tax of PKR 173.8mln (9MFY23: PKR 112mln).

Margins

In FY23, the gross margin and operating profit margin both decreased as compared to FY22. The GP margin decreased from ~13.1% in FY22 to ~9.1% in FY23

due huge rise in manufacturing cost while the OP margin decreased from ~9.1% to ~4.7% during the same period. Resultantly, the net margin of the Company decreased

to ~0.1% during FY23 (FY22: ~4.3%, FY21: ~5.5%) due to high finance. The Company posted a net profit of ~PKR 3mln in FY23 (FY22: ~PKR 201mln, FY21: ~PKR

322mln).

Revenue and Margins

Sustainability

SSTPL is also diversifying by exploring export markets in America and the USA, where it has received letters of intent from customers to purchase tinplates. Furthermore, the implementation of anti-dumping duties on Galvalume and the removal of tax exemptions in FATA/PATA are expected to significantly strengthen local demand for tinplates, contributing to the Company’s profitability. As a sponsor, Siddiqsons Limited remains committed to providing financial support to SSTPL in the event of any contingency/shortfall in cash flows of SSTPL.

Financial Risk

Working capital

The Company’s net working capital days decreased to 83 days as of March 2024 from 110 days. Management has actively optimized working capital by improving supply chain management and negotiating favorable terms with its primary raw material supplier. Additionally, trade receivable days were reduced by adjusting credit terms with customers and shifting a significant portion to advance cash sales.

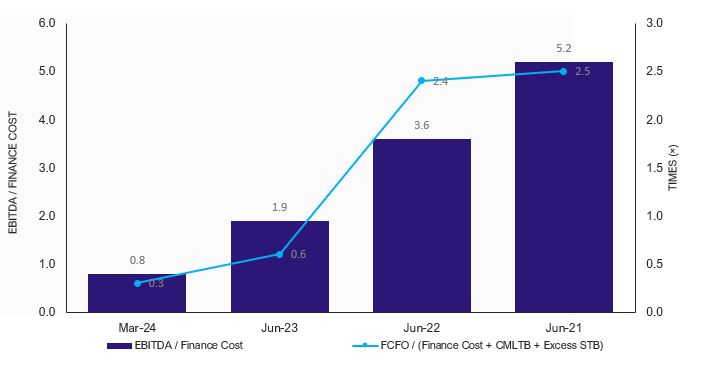

Coverages

In 9MFY24, the Company’s EBITDA declined to approximately PKR 279mln from PKR 353mln in FY23, primarily due to a significant drop in PBT. The EBITDA/Finance Cost coverage ratio decreased from ~1.9x in FY23 to ~0.8x in 9MFY24, while the FCFO/Finance Cost ratio fell to ~0.7x

Coverages

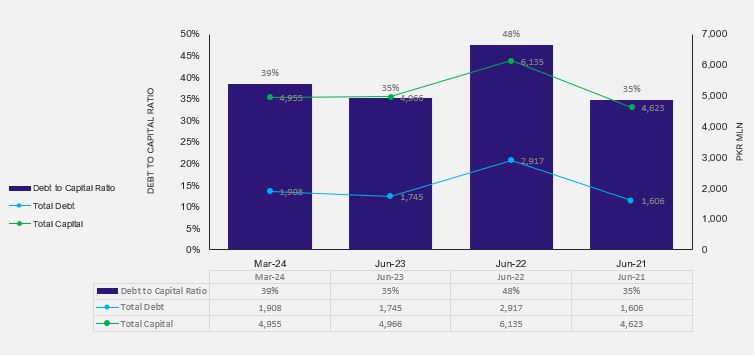

Capitalization

Siddiqsons Tinplate Limited has a moderately leveraged structure, with total leverage at approximately 42.7% as of Mar'2024 (up from 40.8% in Jun'2023). The Company's short-term borrowings decreased significantly from PKR 2,132mlm in Dec'2023 to PKR 1,589mln in Mar'2024. According to management, the short-term borrowings have further declined by PKR 1bln, paid off through the sale of ancillary equipment from the CRC project, resulting in a significant reduction in the Company’s debt burden.

Capitalization

|