Profile

Legal Structure

Service Global Footwear Limited ("SGFL" or "the Company") was incorporated as a public limited company in Pakistan on July 19, 2019, under the Companies Act, 2017. It was subsequently listed on the Pakistan Stock Exchange (PSX) on April 28, 2021. The Company’s registered office is located at Servis House, 2-Main Gulberg, Lahore.

Background

SGFL is a subsidiary of Service Industries Limited (SIL). The Company was established as an export-oriented entity following a decision by SIL’s Board of Directors to demerge and transfer its Muridke manufacturing unit, along with its associated assets, operations, and liabilities, to the newly formed Service Global Footwear Limited through a court-sanctioned scheme. As a result, SGFL was incorporated in 2019. Later, In 2021, the Company was listed on the Pakistan Stock Exchange (PSX). In line with its strategic objectives, the proceeds from SGFL’s Initial Public Offering (IPO) were primarily used to invest in an associated company, Service Long March Tyres (Pvt.) Limited (SLM Tyres), where SGFL currently holds an approximately 18.91% stake. Additionally, SGFL has recently established a wholly owned subsidiary, Dongguan Service Global Limited (DSGL), to focus on procurement, marketing, and product development activities.

Operations

The principal business of SGFL encompasses the manufacturing, sale, marketing, import, and export of footwear, leather, and allied products. The Company operates a manufacturing facility located at 10-KM, Muridke-Sheikhupura Road, Lahore. SGFL has an installed capacity to produce ~4 million pairs of footwear annually (CY23: ~4 million pairs). During 9MCY24, the Company produced ~2.7 million pairs (CY23: ~3.5 million pairs), reflecting a capacity utilization rate of approximately 68% for the period.

Ownership

Ownership Structure

The majority stake in the Company, ~79.3%, is held by Service Industries Limited, with the remaining shares distributed among the general public (~19.4%) and individual investors (~1.3%).

Stability

SGFL’s ownership structure is considered stable, as the controlling stake is held by Service Industries Limited, a well-established entity with over six decades of presence across multiple industries. Additionally, no significant changes in the Company's ownership structure are anticipated in the foreseeable future, further reinforcing the stability and continuity of SGFL’s ownership.

Business Acumen

The sponsors of Service Group are highly respected business professionals with decades of experience across multiple industries. Over the years, the Group has successfully diversified its portfolio into sectors such as tyres and tubes, footwear, technical rubber, and other industries, establishing itself as one of Pakistan's leading business conglomerates. The Group’s robust business growth and successful investments underscore the strategic vision and leadership of its sponsors, showcasing their exceptional business acumen.

Financial Strength

As of September 2024, SIL’s consolidated asset base is ~PKR 53 billion, with consolidated equity standing at ~PKR 24 billion. This solid financial foundation demonstrates the sponsor’s strong financial strength, providing a robust support system for the Company should any need arise.

Governance

Board Structure

The Board of Directors (the Board) of the Company consists of nine members, including three executive directors, three non-executive directors, and three independent directors, one of whom is a female director. Mr. Arif Saeed, a non-executive director, serves as the Chairman of the Company.

Members’ Profile

The Board of the Company is composed of seasoned business professionals, each bringing decades of expertise and experience. Four members represent the Service Group. Mr. Arif Saeed, the Chairman, is an Oxford University graduate and currently also serves as the CEO of Service Industries Limited besides being a director on the boards of Service Long March Tyres (Private) Limited and Servis Foundation. Mr. Arif Saeed has previously held prominent positions, including Chairman of the All Pakistan Textile Mills Association (APTMA) and the Lahore Stock Exchange. Other key members include Mr. Ahmed Javed, a graduate of FC College Lahore, who also serves as Chairman of Service Industries Limited, and Mr. Omar Saeed, an MBA from Harvard Business School, who is currently the CEO of Service Long March Tyres. Mr. Omar Saeed also serves on the boards of Nestlé Pakistan Limited, Systems Limited, and the Hunar Foundation. The independent directors, Mr. Azmat Ali Ranjha, Mr. Abdul Rashid Lone, and Ms. Maleeha Humayun Bangash, are highly regarded professionals with expertise spanning multiple sectors, adding valuable insight and diverse perspectives to the Board.

Board Effectiveness

The Board meets at regular intervals to monitor management’s performance and provide strategic direction. Meetings are conducted according to a pre-defined agenda, and minutes are meticulously documented, with action points communicated to relevant stakeholders. In CY23, the Board held seven meetings, with directors maintaining strong attendance. Additionally, the Board has established two sub-committees to enhance its effectiveness: i) the Audit Committee and ii) the Human Resource & Remuneration Committee. These committees contribute to focused, strategic oversight and play a key role in strengthening the governance structure of the Company.

Financial Transparency

The external auditors of the Company, M/S. Riaz Ahmad and Co. Chartered Accountants, are listed in the 'A' category on the SBP’s panel of auditors. For the year ended December 31, 2023, the auditors issued an unqualified audit opinion on SGFL’s financial statements, affirming their satisfaction with the Company’s compliance with applicable policies and accounting principles.

Management

Organizational Structure

The Company has a well-defined organizational structure, divided into several functional departments, including Operations, Engineering and Special Projects, Innovation and Product Strategy, Quality Control, Accounts and Finance, Sales and Marketing, and Human Resources. Each department features a multilayered hierarchy, led by a qualified and experienced Head of Department. All departmental heads report to the Chief Operations Officer (COO), who in turn reports to the Chief Executive Officer (CEO). Currently, all key positions within the organization are filled, ensuring effective management and operational oversight.

Management Team

Mr. Hassan Javed leads the management team as the CEO of SGFL. A leather technologist from Nene College, UK, and a Shoe Technologist from ISMS School, Czech Republic, he brings a wealth of expertise in the footwear sector. In addition to his role as CEO, he serves as a director on the boards of Service Industries Limited, Service Long March Tyres (Private) Limited, and Servis Foundation. Mr. Hassan has had a long and distinguished career with Service Industries Limited, notably serving as the Resident Director in Gujrat for over 15 years. He has also held the position of Chairman of the Pakistan Footwear Manufacturers Association. He is supported by a team of seasoned professionals, each with significant expertise in their respective fields. Notably, Mr. Hassan Ehsan Cheema, the Chief Operations Officer (COO), holds a Master’s degree in Commerce from the University of Punjab. With more than two decades of experience with the Service Group, Mr. Cheema has held various senior management roles, particularly in production planning, sales, and marketing.

Effectiveness

The Company benefits from a well-established organizational structure with clearly defined roles and responsibilities, supported by an experienced and qualified management team. This contributes significantly to the effective management of the Company and the achievement of its strategic objectives. However, the establishment of management committees could further enhance operational efficiency by bridging inter-departmental gaps and facilitating more streamlined decision-making across functions.

MIS

The Company currently utilizes Oracle EBS Version 12.2.7 as its primary Enterprise Resource Planning (ERP) software solution. The system encompasses multiple modules and is implemented across all departments, providing comprehensive integration. This enables real-time reporting, offering senior management enhanced visibility and supporting more informed and effective strategic decision-making.

Control Environment

To ensure operational efficiency and strengthen internal controls, the Company has established an in-house team of qualified professionals at all levels who are responsible for implementing and monitoring policies and procedures. SGFL also maintains an effective risk management framework, which includes the identification, assessment, and reporting of all types of risks arising from its business operations. This proactive approach helps safeguard the Company’s interests and supports informed decision-making.

Business Risk

Industry Dynamics

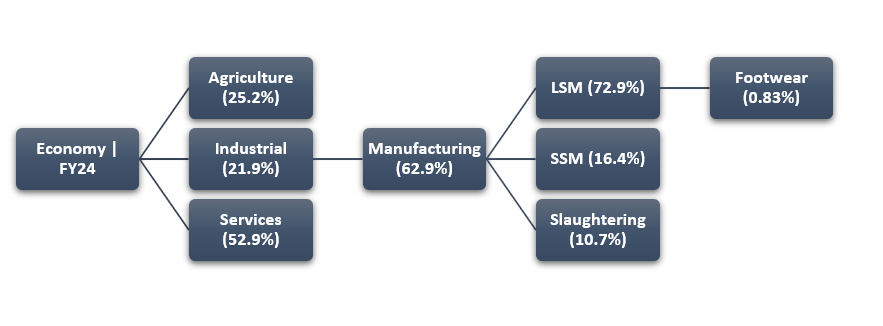

During FY24, Pakistan's nominal GDP stood at ~PKR 106 trillion, with a real growth of around 2.4% year-on-year. The country's footwear market continues to grow, comprising a mix of small and medium-sized enterprises (SMEs) alongside larger manufacturers. Key players in the industry include Bata Pakistan Limited, Service Industries Limited, Stylo, Service Global Footwear Limited, and Service Sales Corporation. In FY24, Pakistan exported ~21.5 million pairs of shoes, reflecting a 4% decline in volume compared to FY23, when exports totaled ~22.4 million pairs. Footwear exports also saw a 9.2% year-on-year decrease in value, falling to approximately ~USD 162 million in FY24 from ~USD 178 million in FY23. This decline reflected ~5.3% drop in the average export price per pair. The decrease in exports can largely be attributed to a significant drop in demand for high-value footwear, prompting producers to lower prices to retain customers or shift focus to more affordable products, which ultimately reduced the overall average price. Major export destinations for Pakistan's footwear include Europe, the Middle East, and the United States of America.

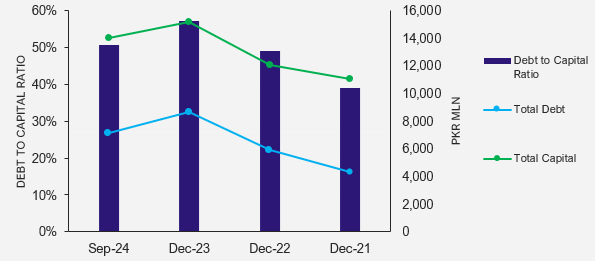

Chart-1: Economy

Relative Position

Service Global Footwear Limited is the largest footwear exporter in Pakistan, currently partnering with globally renowned brands such as Caprice and Dockers. The Company contributes to nearly 40% of Pakistan's total leather footwear exports. SGFL exports over 90% of its total production to more than 20 countries across five continents, establishing a strong international presence in the global footwear market.

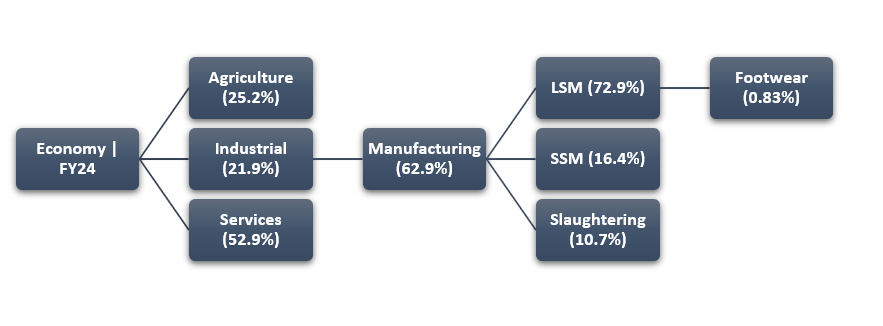

Revenues

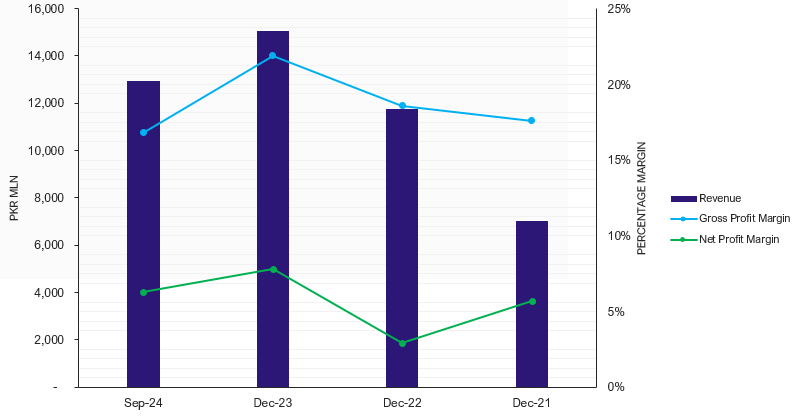

SGFL’s topline clocked in at ~PKR 12,951mln in 9MCY24 reflecting an annualized growth of ~14.7% compared to CY23 when the revenue was reported at PKR ~PKR 15,062mln (CY22: ~PKR 11,753mln). The export sales made up ~98% of the total revenue. The Company’s sales volumes dropped by ~8% in CY23 reflecting dampened demand during the year. However, the sales volumes have shown improvement during 9MCY24. Furthermore, the Company is exposed to customers’ concentration risk as the top 10 customers of SGFL contribute ~90% to the overall revenue.

Chart-2: Revenue & Margins

Margins

In 9MCY24, SGFL's gross margin diluted to 16.8% with gross profit reported at PKR 2,179mln (CY23: 21.9%, CY22: 18.6%). Furthermore, its operating profit margin dropped significantly to ~4.9% from ~9.6% in CY23. The dip in profitability is primarily attributable to an increase in production costs and overheads on the back of significant inflation. The net profit margin stood at 6.3% lending support from the substantial share of profit from SGL’s associated company, SLM Tyres, amounting to ~PKR 944mln recognized by the Company. (CY23: 7.8%, CY22: 2.9%).

Sustainability

SGFL’s management envisages a sustainable footing in the international and local markets by investing in state-of-the-art technology to facilitate the expansion of its existing production lines. The Company is also Asia’s first solar-powered shoe manufacturer with a total solar electricity generation capacity of 2 MW, reflecting the Company’s determination to achieve cost efficiencies and foster growth.

Financial Risk

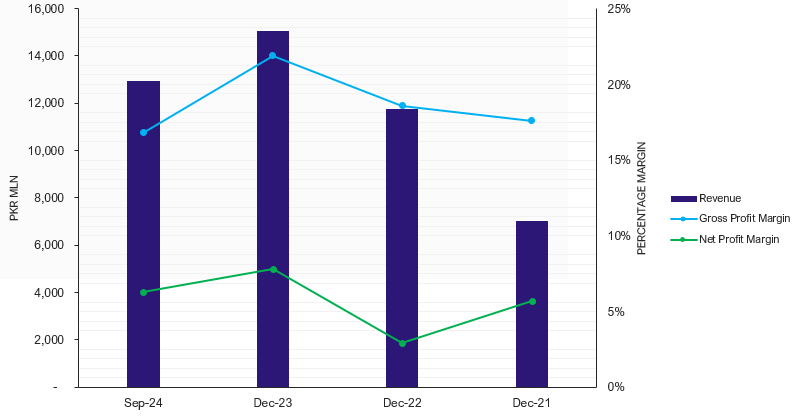

Working capital

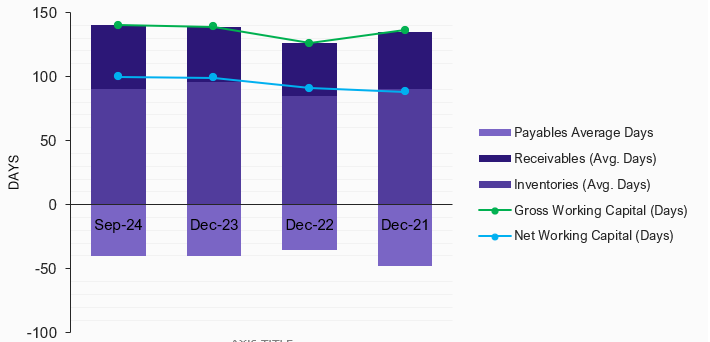

The Company’s capital needs primarily emanate from financing inventories and trade receivables for which it relies on both internally generated cashflows and short-term borrowings. In 9MCY24, the working capital cycle remained stretched owing to high inventory days and receivables days, an inherent necessity based on the Company’s export-oriented business model. The gross working capital cycle stood at 140 days (CY23: 139 days, CY22: 126 days) attributable to increase in receivables days. Subsequently, the net working cycle stood at 100 days in 9MCY24 (CY23: 99 days, CY22: 91 days). Furthermore, the Company maintained a healthy current ratio of 3.6x in 9MCY24 (CY23, 3.4x: CY22, 3.4x).

Chart-3: Working Capital

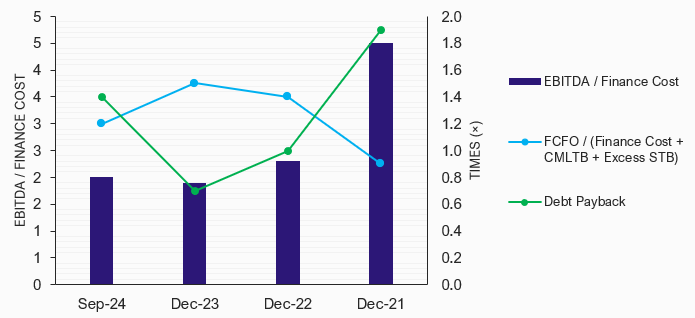

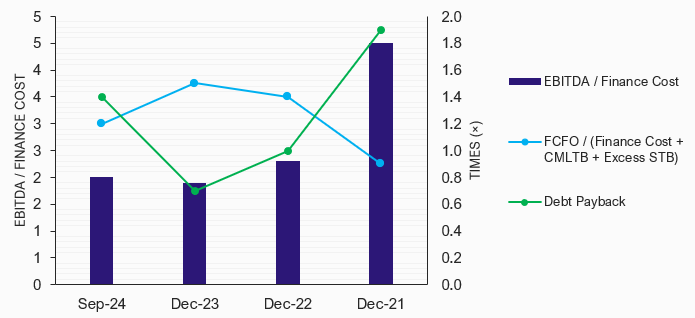

Coverages

In 9MCY24, the Company recorded Free Cash Flows from Operations (FCFO) of ~PKR 681mln (CY23, PKR 1,452mln: CY22, PKR 1,212mln). The increase in profitability margins during CY23 also positively impacted FCFO during the year. However, decline in profitability margins have hindered the growth in cashflows which have remained stagnant during 9MCY24. Furthermore, Interest and core coverage ratios stood at 1.4x & 1.2x respectively during the period (CY23: 1.6x & 1.5x) reflecting a modest coverage of finance costs and debt through Company’s cashflows.

Chart-4: Coverages

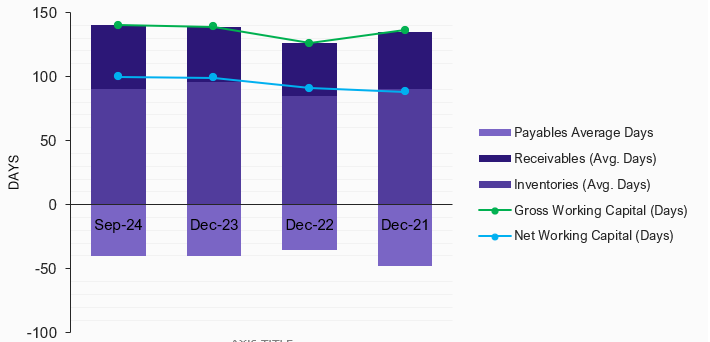

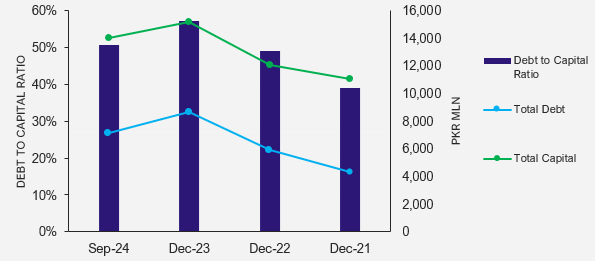

Capitalization

SGFL’s capital structure remains leveraged. However, the gearing ratio of the Company has improved to ~50.7% compared to CY23 when it was recorded at ~57.1%. (CY22 ~48.9%) attributable to decreased borrowings during the period. The Company’s total borrowings were recorded at PKR 7,119mln as of Sep’24, out of which PKR 6,785mln is attributed to short-term debt, effectively constituting ~95% of the total debt portfolio. SGFL has provided a loan of ~PKR661mln to its holding company, SIL. Furthermore, a major portion of the Company’s debt is composed of concessionary export based loans, enabling the Company to minimize the associated finance costs.

Chart-5: Capitalization

|