Profile

Legal Structure

Getz Pharma (Private) Limited ("Getz Pharma" or "the Company") was incorporated as a private limited company in Pakistan on September 19, 1995, under the now-repealed Companies Ordinance, 1984 (currently governed by the Companies Act, 2017). The Company's registered office is situated at 29-30, Sector 27, Korangi Industrial Area, Karachi.

Background

Getz Pharma was founded in 1995 through the acquisition of a locally owned pharmaceutical company, Saitex Laboratories (Private) Limited. Following the acquisition, the company was rebranded as Getz Pharma (Private) Limited. As early as 1998, Getz Pharma started exporting its products to Vietnam, Thailand, and Sri Lanka. By 2005-06, Getz Pharma created legal entities, scientific offices, and representative offices in ten countries and started to export its products which were manufactured at its manufacturing facility in Karachi. The big boost to Getz Pharma’s exports came in 2013 when the Company accomplished its vision and dream of getting its Quality Control laboratory pre-qualified by WHO-Geneva, being the first in Pakistan. Shortly after, the Company also got its manufacturing facility prequalified and approved by WHO-Geneva and PIC/s. This was made possible due to the Company’s consistent re-investment in facilities, systems, technology, and the training and development of its human resources. In the Pakistan market, the Company is rated by IQVIA as the largest pharmaceutical company of Pakistan. The Company is also the largest taxpayer and the largest investor in the pharmaceutical industry of Pakistan.

Operations

Getz Pharma manufactures and markets over 300 products in various therapeutic segments and galenical forms. The Company has a large R&D department where it designs and develops therapeutically equivalent drugs which are then challenged and passed for Bioequivalence and pharmaceutical equivalence. Getz Pharma has been consistently investing in the local production of new and innovative manufacturing technologies. In 2006, the Company set up the first insulin manufacturing facility which was the only insulin manufacturing facility in Pakistan till 2024. By 2022, the Company opened its new one million square feet manufacturing plant, named “Astola manufacturing facility” which is not only the single largest investment of any pharmaceutical manufacturing company of Pakistan but is also the only LEED (Leadership in Energy and Environmental Design) Platinum-certified plant in entire South Asia, recognized by the US Green Building Council.

Ownership

Ownership Structure

Getz Pharma is a wholly owned subsidiary of Development Holdings Asia Limited, Bahamas (DHAL). DHAL is owned by two partner companies - DHAL-BVI owned by the family of Mr. Raymond Simkins and by Scitech International owned by the family of Mr. Khalid Mahmood.

Stability

The ownership structure of the Company is considered stable, as it has remained under the control of the current sponsors for several decades, with no changes expected in the foreseeable future.

Business Acumen

The sponsors, Getz Bros., have an extensive portfolio of businesses across several countries, spanning sectors such as healthcare, FMCG, chemicals, and construction. The sponsors' diverse business ventures and successful track record demonstrate their strong business acumen and expertise across multiple industries. Getz Brothers are involved in a wide range of diversified businesses across multiple industries, including healthcare and FMCG. In addition, they also hold shares in Muller & Phipps and Briogene (Private) Limited in Pakistan. Mr. Khalid Mahmood has over 43 years of experience in Pharmaceutical companies in progressive positions of seniority from manufacturing and quality management to projects, technology management, marketing, and business development to managing subsidiaries during his tenure with US-based international pharmaceutical companies.

Financial Strength

Getz Pharma has consistently demonstrated exceptional financial strength which has resulted from its outstanding and consistent operational and financial performance for the past 20 years it has consistently shown the highest ROI, ROCE, ROE, PAT, and leverage ratios amongst all the pharma and FMCG companies of Pakistan. The Company's profitability, financial position, and key financial ratios have shown continuous improvement that has been officially acknowledged at the Government level as being awarded the Highest Exporter Trophy for 18 consecutive years and recipient of the highest taxpayer award for 15 consecutive years. Additionally, the Company has one of the most diverse product portfolios, of ethical and prescription drugs. It has leadership in many therapeutic areas, such as cardiometabolic, gastroenterology, anti-infectives, urology, etc. In 2022, the company formed a new subsidiary of consumer health products under its subsidiary company “Getz Life”. Within a short time, it launched products like Livity which is a renowned food supplement for young adults as well as convalescing patients which is growing the top line and the bottom line of the Company as well as contributing in the growth of the Company’s exports. The sponsors also have an extensive business enabling them to provide robust support to the Company, if needed, although Getz Pharma has been thriving independently on its financial merits.

Governance

Board Structure

Getz Pharma’s Board comprises two experienced professionals from the pharmaceutical and healthcare industry background i.e. Mr. Khalid Mehmood and Mr. Raymond Simkins, as nominee directors representing Development Holdings Asia Limited.

Members’ Profile

The Group CEO, Mr. Khalid Mahmood, is the founder CEO of Getz Pharma, when it was formed in 1995. With a distinguished professional background and over 40 years of experience, he previously served as the President of WWF for six years. Mr. Mahmood is currently on the board of Zindagi Trust and IBA, the leading business school of Pakistan. He has received Tamgha-e-Imtiaz from the Government of Pakistan for his contributions to the economy of Pakistan. He has also held progressively senior roles in the pharmaceutical and healthcare industries across the USA, South America, Southeast Asia and Africa before leading Getz Pharma. Mr. Raymond Simkins, the President of Getz Bros. and the Getz Group, brings over 48 years of experience in managing companies across the USA, Europe, and Asia. Before assuming the role of President at Getz Bros. in 2003, he was the Chairman and CEO of Getz Bros. Inc. in Japan, where he pioneered the medical devices business, growing it into the largest marketing and distribution company for medical devices in the region. Mr. Simkins has collaborated with major Corporations such as Merck, Roche, Bristol Myers Squibb, Medtronic, St. Jude, Guidant, and Boston Scientific. He has also led the group's venture capital program, investing in numerous start-ups in the USA, Europe, and Japan, and serving on their boards.

Board Effectiveness

Monthly business performance reports are submitted to the Directors, ensuring they stay informed of the Company’s progress. The Board meets regularly to assess the Company’s strategy, key developments, risks, and opportunities, effectively fulfilling the functions typically handled by Board Committees. This approach enables the Board to maintain a hands-on and comprehensive oversight of the Company's operations and strategic direction.

Financial Transparency

The Company’s external auditors, EY Ford Rhodes Chartered Accountants, are among the Big 4 and are classified in Category ‘A’ on the SBP’s panel of auditors. They have issued an unqualified opinion on the Company’s financial statements for the year ended December 31, 2023, confirming their satisfaction with the Company’s compliance with applicable policies and principles.

Management

Organizational Structure

The Company has a clearly defined organizational structure consisting of 9 functional departments, each with a multilayered hierarchy, and is led by a qualified department head. Each department head reports directly to the Group CEO. At present, all key positions within the organization are fully staffed.

Management Team

Mr. Khalid Mehmood is the Group CEO of Getz Pharma. He has more than 4 decades of experience in the pharmaceutical research and development, operations, and marketing of the pharmaceutical industry. He is supported by an experienced core management team that has a long association with the Company. Mr. Yahya Zakaria, is the CFO, a qualified Chartered Accountant, with over 27 years of experience with the largest MNC, Pharmaceutical company, and later with a large FMCG company. The Company also has four Chief Operating officers, (COOs) in the areas of Global Commercial Operations, R&D, Regulatory and Business Development, Quality Management Systems, and Supply Chain and manufacturing operations.

Effectiveness

The Company’s well-defined organizational structure, with clearly established roles and reporting lines, coupled with a qualified and experienced core management team, enhances the overall effectiveness of management. Additionally, the Executive Committee, a management body comprising fourteen members and chaired by the Group CEO, further strengthens operational efficiency. This committee plays a crucial role in bridging inter-departmental gaps and facilitating timely and effective decision-making across the organization.

MIS

Getz Pharma has implemented and is utilizing all key modules of SAP ECC-6.0, providing a real-time, end-to-end integrated solution for operations across finance, sales and marketing, production, procurement, quality management, and human capital management. The upgraded SAP HANA database version has been successfully deployed, enhancing system performance. Additionally, Getz Pharma’s Enterprise System—SAP HANA—is GMP-V certified and accredited by the German Accreditation Body for Enterprise Management, ensuring compliance with global standards for enterprise management systems.

Control Environment

A comprehensive Management Information System (MIS) is submitted to the Group CEO on a monthly basis, including an income statement, segment-wise and region-wise breakdowns of revenue and profit, efficiency variance reports, as well as receivables, payables, and inventory aging reports, and an operational expenditure summary. The Business Intelligence module offers a high-level overview of the Company's data, supporting top management in making informed strategic decisions. Additionally, the Company has established a robust quality management function that assesses and mitigates risks associated with business operations while ensuring compliance with applicable quality standards in the production process.

Business Risk

Industry Dynamics

The healthcare services industry is generally considered low-risk due to its limited demand cyclicality. As of June 2024, the industry's size is approximately PKR 916 billion, up from PKR 750 billion in June 2023. According to the recent IQVIA report, the top ten pharmaceutical companies account for about 48% of the market. However, the sector's heavy reliance on imported raw materials (APIs) exposes it to risks such as supply disruptions and foreign exchange losses, particularly due to the devaluation of the Pakistani Rupee (PKR). Additionally, increased borrowing costs, driven by high interest rates, have hindered profitability growth. The sector also faces challenges in passing on cost increases to consumers, as prices are regulated. On a positive note, the recent deregulation of prices for non-essential medicines, along with PKR stabilization and a decline in interest rates, has provided the industry with some relief in recent quarters.

Relative Position

Getz Pharma manufactures and markets over 300 ‘branded generic/ products. The Company’s market share of 7.3% is the highest amongst the 650 pharmaceutical companies of Pakistan. As the largest player in Pakistan's domestic pharmaceutical industry, the Company is also ranked among the top 40 largest exporters in the country. It is the only pharmaceutical company that has made it to the State Bank of Pakistan’s list of 100 top exporters. Its exposure to currency exchange risk is relatively mitigated, with exports accounting for 31% of total revenue. Getz Pharma’s ranking and market share, in other countries like Philippines, Kenya, Cambodia, etc. have also consistently increased in the last five years.

Revenues

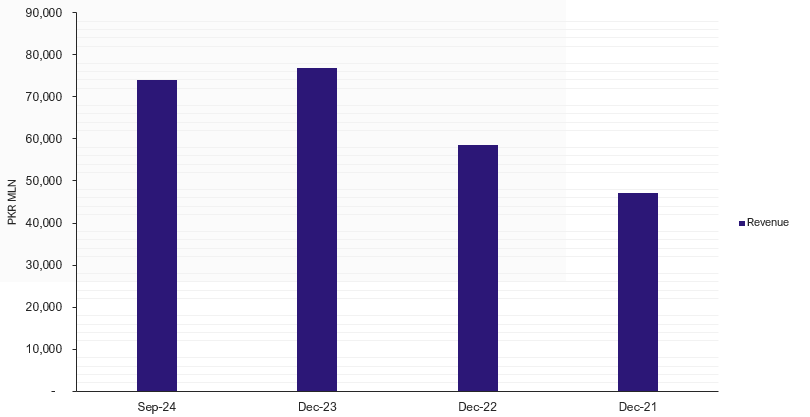

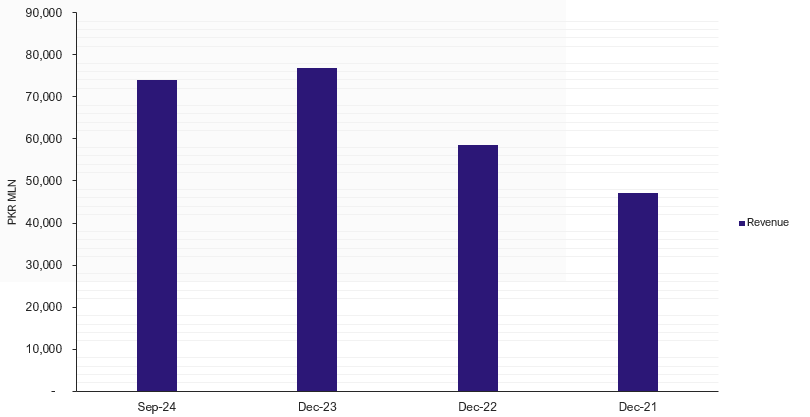

In CY23, the Company’s revenue grew by 31% year-on-year, reaching PKR 76,776mln, compared to PKR 58,453mln in CY22. This growth was driven by a mix of both volumetric increases and price adjustments. Export sales contributed PKR 23,910 million in CY23, demonstrating the sustainability of Getz Pharma's export clientele. Furthermore, for the nine months of CY24, the Company's sales totaled PKR 74,044 million, reflecting an annualized growth of 28.6%, driven by volumetric growth and favorable price adjustments.

Chart-1: Revenue

Margins

The Company’s gross and net margins slightly decreased in CY23, due to the devaluation of the PKR, high inflationary pressure and double-digit increase in energy and other operating costs. Despite these challenges, overall margins remained strong, though partially offset by the depreciation of the rupee and high borrowing costs resulting from elevated interest rates. Nonetheless, the company has maintained steady profit growth over the years, achieving a healthy bottom line. Additionally, for the 9MCY24, the Company’s net profit margin improved marginally driven by a reduction in finance costs.

Sustainability

Getz Pharma stands to gain significant benefits from group synergies, including (i) bulk discounts from raw material suppliers and (ii) enhanced banking relationships. The Company has recently completed a major expansion with the 'Astola Project,' a green field manufacturing and packing facility. As the existing facility has reached its maximum capacity, the new facility will support the rapidly growing local and export markets, ensuring continued growth through 2025 and beyond.

Financial Risk

Working capital

The gross cash cycle days increased during CY23, reaching 181 days compared to 149 days in CY22. Working capital requirements are managed through a combination of internally generated cash flows and short-term borrowings. The extended working capital cycle was primarily driven by an increase in inventory days to 133 days (up from 98 days in CY22), reflecting the company’s strategy to build up inventory in response to ongoing PKR devaluation and supply chain challenges. However, the company’s working capital cycle improved during 9MCY24, with a net working capital cycle of approximately 96 days, due to a reduction in average inventory levels.

Coverages

The Company maintained healthy coverage ratios as of CY23, with an EBITDA to Finance cost ratio of 5.0x (compared to 9.6x in CY22) and a debt payback ratio of 0.4x. The coverage ratios weakened in CY23 due to an increase in nance costs, driven by high interest rates. However, during 9MCY24, the company’s coverages improved, reflecting enhanced profitability and a reduction in finance costs. The interest coverage ratio increased to 7.1x, while the core coverage ratio improved to 3.5x.

Chart-2: Coverages

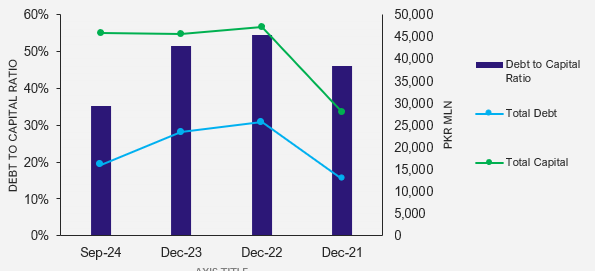

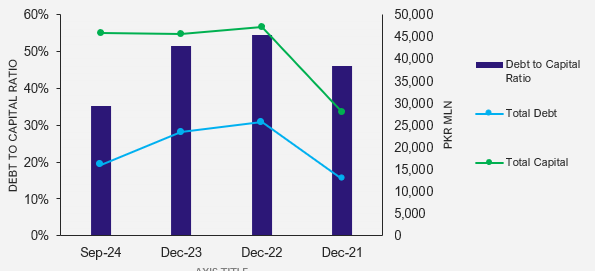

Capitalization

Getz Pharma's capital structure improved during 9MCY24, with the leverage ratio decreasing to approximately 35%, compared to around 51% in CY23. As of September 2024, the company’s total debt stood at PKR 16 billion. The breakdown of borrowings is as follows: PKR 9,710 million in short-term borrowings for working capital, and PKR 4,105 million in long-term borrowings.

Chart-3: Capitalization

|