Profile

Legal Structure

Multi Resin Industries (hereinafter referred to as “the Firm”) is a Partnership Firm established in 1997 and registered under the Partnership Act of 1932. The Firm’s registered office is located at Islamic Arcade, C-3, University Road, next to the Samama Shopping Mall in Karachi.

Background

The business was originally founded by the sons of the late Mr. Muhammad Sharif in Hyderabad, Sindh, with an initial production capacity of 30 tons per month. Over the years, the Firm expanded its operations to major cities across Pakistan, including Karachi, Lahore, Faisalabad, Rawalpindi, Islamabad, and Peshawar. In 2004, the Firm established an office and warehousing facility in Lahore, followed by another in Faisalabad in 2013.

Operations

The Firm specializes in the production and sale of chemical emulsions, including adhesive emulsions, homo polymers, co-polymers, cross-linking agents, acrylates-based dispersions, pure acrylates emulsions, and styrene-modified acrylates emulsions. These products, marketed under the brand name Multiteck, are extensively utilized across a variety of industries such as textiles, paints, paper and packaging, construction, leather, and wood sectors.

Ownership

Ownership Structure

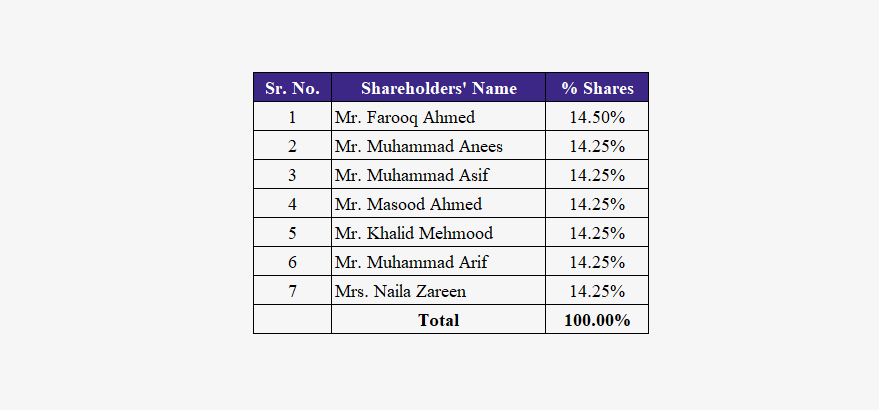

Multi Resin Industries is registered as a Partnership Firm, with ownership divided among seven partners. Mr. Farooq Ahmed holds a 14.5% stake, while the remaining six partners each own a 14.25% share.

Table 1: Shareholding

Stability

Multi Resin Industries is currently owned almost equally by its seven partners, showcasing a well-balanced ownership structure. To ensure long-term stability and sustainability, it is crucial to implement a formal succession planning process. This will safeguard the Firm’s future prospects and provide a clear roadmap for leadership transitions. By proactively preparing for unforeseen circumstances, the Firm can maintain its operational integrity and secure its position in the market for years to come.

Business Acumen

The key partner, Mr. Farooq Ahmed, alongside partners Mr. Muhammad Anees and Mr. Muhammad Asif, collectively bring over 23 years of extensive experience in the chemical industry. Their combined expertise and profound understanding of market dynamics have been pivotal in steering the Firm towards sustainable growth.

Financial Strength

The financial strength of the sponsors is deemed adequate, as they have consistently demonstrated the capability to directly finance the business through substantial capital injections. The sponsors’ commitment to injecting capital underscores their dedication to the Firm’s financial resilience.

Governance

Board Structure

The overall control of the Firm rests with seven partners. Besides the Chairman, two partners hold executive roles within the Firm. While the current governance structure provides a degree of oversight and management, there is ample room for improvement. As Multi Resin Industries operates as a partnership, enhancing the governance framework could foster more robust decision-making processes, risk management, and strategic planning.

Members’ Profile

The business is led by three highly experienced individuals with over twenty-three years of experience in the chemical industry. Mr. Farooq Ahmed, the Chairman, is a chemical engineer with more than two decades of expertise in the field. His visionary leadership has been the cornerstone of the Firm’s success. Alongside him, the other two partners also bring a wealth of knowledge and experience, significantly contributing to the Firm’s operations and strategic direction. Their collective expertise ensures that the Firm remains at the forefront of the industry, continually driving innovation and excellence.

Board Effectiveness

The Firm currently lacks a formal board committee, which can hinder effective governance. Additionally, three partners hold management positions within the Firm, which restricts the scope for impartial oversight and strong governance practices. To enhance board effectiveness, it is crucial to establish a dedicated board committee and separate management roles from governance functions. Implementing these changes will allow for more balanced decision-making, increased transparency, and better accountability, ultimately driving the Firm towards sustained growth and success.

Financial Transparency

M/S Clarkson Hyde Saud Ansari - Chartered Accountants, a QCR rated firm, is the external auditor of the Firm. The auditors have expressed an unqualified audit opinion on the financial statements of Multi Resin Industries for the year ended June 30, 2024. This unqualified opinion signifies that the financial statements present a true and fair view of the Firm’s financial position, in accordance with applicable accounting standards. To further enhance transparency, it is recommended to engage external auditors from the SBP panel.

Management

Organizational Structure

Multi Resin Industries operates with a streamlined organizational structure, segregating its operations into six key departments: (i) Sales & Marketing, (ii) Information Technology, (iii) Procurement, (iv) Operations Management, (v) Quality Control, and (vi) Finance. Each department has clearly defined lines of responsibility, ensuring that tasks and roles are effectively managed and executed.

Management Team

The management team of Multi Resin Industries comprises experienced and skilled individuals who play pivotal roles in the firm's success. Mr. Farooq Ahmed, the Chairman, and Mr. Muhammad Anees, the CEO, are deeply involved in key decision-making processes. Mr. Muhammad Asif, a textile engineer, heads the Sales & Marketing department, bringing specialized expertise to this crucial area. Mr. Amir Parvaiz, the CFO, is a chartered accountant with extensive experience, ensuring the firm's financial health and strategic planning. Additionally, Mr. Ubaid Farooq, the son of Chairman Mr. Farooq Ahmed, is actively involved in the business and currently oversees overall operations. His involvement ensures continuity and brings fresh perspectives to the firm. Together, this dynamic management team drives the strategic vision, operational excellence, and sustained growth of Multi Resin Industries.

Effectiveness

Multi Resin Industries, supported by a qualified and experienced team of professionals, is steadily enhancing its business strengths and expanding its footprint across various cities in Pakistan. The management team’s roles and responsibilities are clearly defined and well-structured, allowing for efficient and effective achievement of the Firm’s strategic goals and objectives. This clarity in function and purpose enables the Firm to focus on key growth areas, optimize operational processes, and swiftly adapt to market changes.

MIS

Multi Resin Industries utilizes Oracle software, specifically version 9i, provided by Afroz, to manage its Management Information System (MIS). This robust software solution effectively tracks various financial and operational aspects of the business, including receivables, payables, general ledger entries, and overall accounts management. The use of Oracle 9i enhances the firm's ability to maintain accurate and up-to-date financial records, streamline accounting processes, and ensure compliance with relevant financial regulations.

Control Environment

Multi Resin Industries follows a balanced and environmentally friendly growth strategy in all its operations. The Firm has adopted sustainable growth principles that emphasize reducing environmental harm. This commitment to sustainability is reflected in its initiatives to minimize waste, conserve resources, and adopt eco-friendly practices across all aspects of its business. In recognition of its efforts, the Firm was awarded the ISO 9001-2008 certification by TUV Austria Hellas (formerly Moody Intertek) in 2009. This certification underscores the Firm’s dedication to maintaining high standards of quality management and environmental responsibility. By integrating these principles into its operational framework, Multi Resin Industries not only enhances its environmental performance but also strengthens its reputation as a responsible and forward-thinking organization.

Business Risk

Industry Dynamics

In FY24, Pakistan’s nominal GDP was ~PKR 99.5 trillion (FY23: PKR 79.6 trillion), with real terms growth of ~2.52% year-over-year (YoY) (FY23: ~-0.22% growth). Industrial activities contributed ~17.8% (FY23: ~18.4%) to the GDP, while manufacturing activities accounted for ~12.0% (FY23: ~11.9%) of the total GDP. The Chemical sector, classified as a Large-Scale Manufacturing (LSM) industrial component, had a weight of around 2.6% in the Quantum Index of Manufacturing (QIM) in FY24. The sector’s performance in QIM experienced ~3.1% YoY negative growth during 10MFY24 mainly attributable to soaps and detergents, chlorine and Sulphuric acid segments, that experienced a YoY negative growth of ~22.4%, ~13.2% and ~7.4%, respectively, over this period.

The resins manufacturing segment operates in a highly competitive market owing to un-segmented and unorganized small producers who pose threat to large-scale manufacturers. Because of simplicity in the production process, the segment remains competitive while margins reported are relatively on the lower side. Multiple sectors come under the umbrella of Firm’s exposure since it manufactures chemical emulsions & resins which cater to diversified needs. Resins primarily drive its demand from textile, paper & packaging, paint, construction and wood sectors. Thus, each sector exhibits a different demand and supply dynamics, resultantly impacting Multi Resins position in the market differently. The growth in resins segment is dependent upon the overall economic growth with major contribution coming from coatings and paints. Raw material holds the biggest portion in cost of production. The production capacity of the segment was ~113,000MT in FY23 (SPLY: ~107,111MT). Meanwhile, utilization levels clocked in at ~74.1% during the year (SPLY: ~77.6%).

Relative Position

The demand for Firm’s products relies on the economic activities, growth of prime market and related sectors. The Firm operates in a highly competitive environment, predominantly covered by MNCs & large-scale local producers. Hence, the management is continually taking necessary actions to mitigate the opposing effect of the threats through efficient utility systems, enhanced focus on R&D, product diversification, and adaption of new technology. The Firm holds ~10% market share and is tempering its position to grow & sustain as one of the major players for the supply of water-based emulsions in textile and paints & coating sectors.

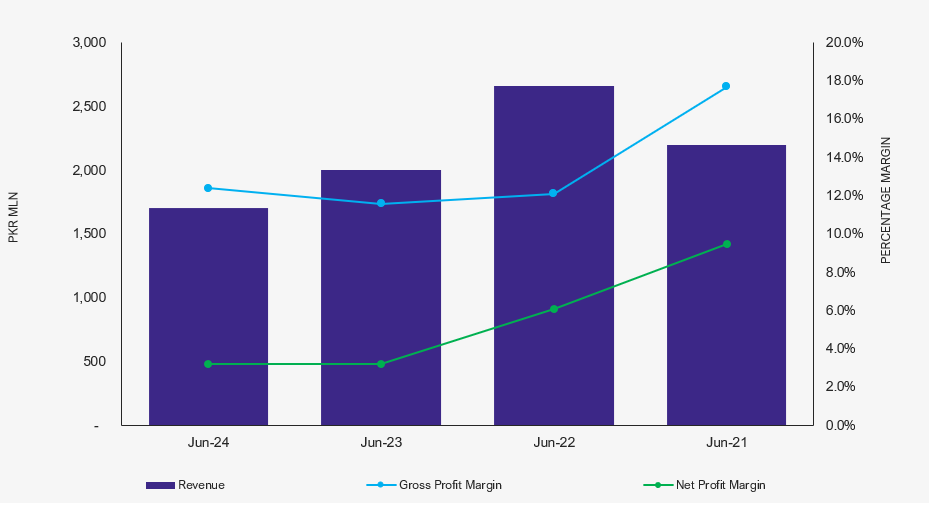

Revenues

During FY24, topline of the Firm clocked at ~PKR 1,709mln, marking a decline of ~14.7% YoY. This decline in topline highlights the challenges faced by the Firm in maintaining its revenue base amidst fluctuating market conditions. The sales mix has been consistently dominated by local sales, which constitute around 98% of total sales. The major contributor is the Textile segment, contributing ~70.75% to the total revenue. The Paint segment follows, accounting for ~16.54%, while the Leather and Construction segments collectively contribute the remaining 12.71%.

Margins

In FY24, the Firm experienced a modest increase in margins across all levels, with the Gross, Operating, and Profit margins reaching ~12.4%, ~9.7%, and ~3.2%, respectively (FY23: ~11.6%, ~9.4%, and ~3.2%).

Graph 1: Profitability Matrix

Sustainability

Multi Resin’s management envisage sustainable footing in the market by planning to move to a private limited company structure instead of partnership in near future and will continue to work for a sustainable future with more efficient and successful projects with high user demand, technical competency, creativity and corporate responsibility. New projects in pipeline stand to lift the topline as the Firm’s eyes geographical diversity in its business stream.

Financial Risk

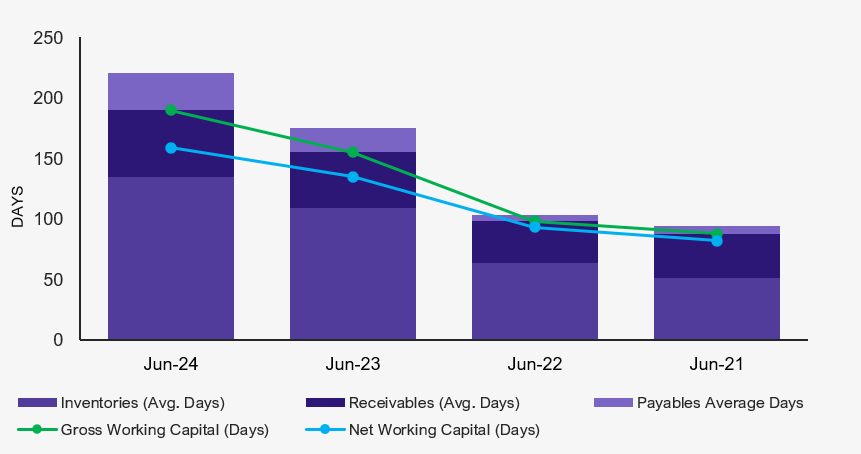

Working capital

The Firm predominantly relies on equity-based funding. For its working capital needs, which are driven by inventory and receivables, the Firm depends on internal cash flows. The Firm’s average gross working capital cycle increased to ~190 days in FY24 from ~155 days in FY23, primarily due to an increase in inventory days to ~135 (FY23: ~109 days). Additionally, the net working capital cycle expanded to ~159 days in FY24 from ~135 days in FY23. As a result, the Firm’s cash cycle has significantly extended during FY24, reflecting a more pronounced reliance on internal funding to sustain operations.

Graph 2: Working Capital Management

Coverages

The Firm’s core-debt coverage ratio improved to 1.6x in FY24, up from 1.0x in FY23. To date, the Firm has primarily relied on equity funding and has not procured long-term debt. This conservative approach has preserved financial flexibility, allowing the Firm ample capacity to procure debt in the future if circumstances require it, thus providing a solid foundation to support potential growth initiatives.

Graph 3: Financial Coverages

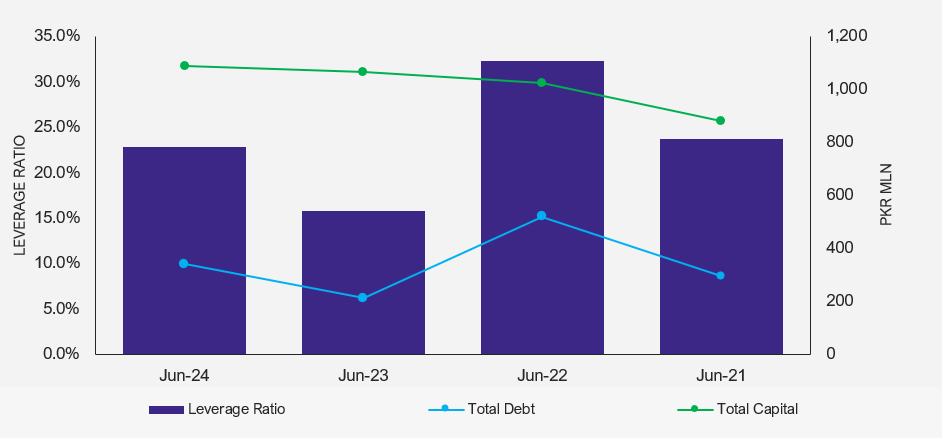

Capitalization

During FY24, Multi Resin Industries reported a leverage ratio of ~22.8%, up from ~15.8% in FY23. The Firm’s debt burden consists solely of short-term borrowings, amounting to ~PKR 340mln in FY24 (FY23: ~PKR 212mln). Notably, the Firm has not yet utilized any long-term credit facilities from banks or financial institutions, which provides it with significant flexibility to secure long-term financing in the future if needed to support its growth initiatives.

Graph 4: Capital Structure

|