Profile

Legal Structure

MACPAC Films Limited ("MACPAC" or the "Company") was incorporated as a Public Limited Company in 1993. The Company is listed on the Pakistan Stock Exchange

Background

The Company started commercial production of Biaxially-Oriented Polypropylene (BOPP) films in 1995. In 2003, the Company set up a new plant for Cast Polypropylene (CPP) films to diversify its existing product range. After a fire incident in 2007, the Company had to halt the manufacturing of the CPP line. In 2014, the Company ventured into install a Metalizer plant for BOPP Films, which started its commercial production in 2015. In 2017, the Company started to reinstall the CPP manufacturing line which became commercially operational in Jan-19.

Operations

MACPAC Films Limited is considered to be the pioneer of Biaxially - Oriented Polypropylene (BOPP) and Cast Polypropylene (CPP) films in Pakistan, with rich experience and a strong brand identity. Keeping in view the market dynamics for transparent, matte, pearlized and metallized films; the Company manufactures them in different varieties and thicknesses - ranging from 10 to 40 microns.

In July 2024, Macpac Films Limited received its Shariah Compliance Certification, aligning its operations and financial activities with Islamic financial principles. This certification broadens the Company’s investor base by appealing to Shariah conscious investors and reflects our commitment to ethical business practices.

Ownership

Ownership Structure

MACPAC Films is primarily owned by the Elahi family (47.65%). Among the sponsoring family, major ownership vests with Mr. Ehtesham Maqbool Elahi (16.60%), Mr. Shariq Maqbool Elahi (15.45%) and Mr. Habib Maqbool Elahi (15.45%). Munshi family has an ownership stake of (15.35%) in the Company. The GOP through Employees Old Age Benefit owns a (7.87%) stake in MACPAC. The Company has a free float of 35%

Stability

Ownership of the business is seen as stable as the major ownership vests with the Elahi family. The second generation of the family has been fully inducted into the business for many years.

Business Acumen

The sponsors through their vast experience, have become reliable partners for the flexible packaging films industry, by making the Company consistently comply with the standards of high quality

Financial Strength

MACPAC Films is a financially sound business entity. The Company’s sister concern TOYO Packaging Pvt Ltd, TGA sustainability (Pvt) Limited also has a broad portfolio of customers. This strong forward integration strengthens the customers bond and gives a competitive edge through strong supply chain support.

Governance

Board Structure

MACPAC Films BoD comprises two Independent Directors, three Non-Executive Directors and two Executive Directors.

Members’ Profile

The BoD, with the diversified background and expertise of its members, is a key source of oversight and guidance for the management. Board’s Chairperson, Mr Naeem Munshi (Non – Executive Director) has been associated with the Company since its inception.

Mr. Ehtesham Maqbool Elahi is an executive member of Board and happens to be an alumnus of American university in Dubai and a certified Director from PICG, having around two decades of experience of senior level managerial positions in multiple associated companies of MACPAC Films Limited.

Mr Shabbir Hamza Khandwala is an independent director in the Company, and he is a fellow member of the Institute of Chartered Accountants of Pakistan and carries with him 40 years of diversified experience of various sector. He is a Chairman of Board's audit committee as well. He has been the CFO & Group head finance of Meezan bank from March 2005 to September 2022.

Ms Hafsa Abbasy also is an independent director. She is a seasoned HR professional, having worked for some of the renowned financial institutions, namely (Citi Bank, ABN Amro, Standard Chartered). She is also chairperson of Human Resources & Remuneration Committee.

Mr Shariq Maqbool Elahi is serving as a non-executive Director and a member of the Board Audit Committee and the HR & Remuneration Commitee. He is also director of multiple associated companies of MACPAC Films Ltd.

Mr Fahad Munshi hold a bachelor's degree from Bently University in Waltham. He has over 10 years of experience as Head of Operations of Hilal Foods and currently associated as MD of Hilal Foods. He is associated as non-executive Director of the Company.

Board Effectiveness

The minutes of the BoD meetings are well documented and circulated on time. To ensure effective governance, the Board has formed two committees, namely Audit Committee and Human Resource and Remuneration Committee

Financial Transparency

The Audit Committee ensures an accurate reflection of the Company's financial performance, and effectiveness of the internal controls in place. MACPAC Films' external audit of June 24 was completed by M/s KPMG Taseer Hadi & Co and they expressed an unqualified opinion on the financial reports.

Management

Organizational Structure

To perform well, MACPAC Films maintains a structured organogram. The Company operates through various departments 1) Supply Chain department, 2) Sales and Marketing department, 3) Finance department, 4) Internal Audit department, 5) Human Resource department, 6) Information Technology and 7) Administration department.

Management Team

MACPAC Films Limited has a set of experienced & professional management. The Company’s CEO, Mr. Najam ul Hassan is associated with MACPAC Films since 2017. He has extensive experience of two decades in different sectors and prior to assuming the CEO slot, he also served as COO of the Company. Mr. Mohammad Fahad, head of the internal audit department, is equipped with over 15 years of diverse industry experience post-qualification as a Chartered Accountant from KPMG. His expertise encompasses a broad skill set, including corporate secretarial responsibilities, with a strong focus on ensuring compliance and governance across the organization. Mr. Muhammad Faisal Panawala serves as the Chief Financial Officer at Macpac Films, bringing over 19 years of expertise in financial planning. He is a Fellow Chartered Management Accountant, a Chartered Global Management Accountant (CGMA), and holds an MBA in Finance, along with a certification from IBA.

Effectiveness

Management’s effectiveness and efficiency is being ensured through the presence of management committees. At Macpac, management committees are in place, in line with best industry practices.

MIS

MACPAC Films manufacturing facilities in Port Qasim are connected with the Company’s Head Office in Karachi through an ERP. To support management, the Company generates various reports on Finance, Sales, HR, Production, and Import on a daily and monthly basis. The implementation of SAP (S/4HANA) was successfully completed on January 4, 2024, and is now live to enhance operational efficiency. Additionally, the Sales Force System is also live since Oct-23, to enhance customer relation management.

Control Environment

The Company has an internal audit function in place, which provides an effective mechanism for the identification, assessment and reporting of all types of risks arising out of the business operations. This function provides support, guidance and monitoring of the internally placed SOPs along with conducting Gap Analysis for evaluating already placed policies and procedures.

Business Risk

Industry Dynamics

The packaging industry in Pakistan is categorized into primary segments: 1) paper, 2) plastic, 3) tinplate, and 4) glass. Among these, the paper and plastic segments dominate the market, holding the largest share of total demand. The plastic packaging segment, particularly Biaxially Oriented Polypropylene (BOPP) and Cast Polypropylene (CPP) films, is integral to the FMCG and consumer goods industries, which drive significant demand due to the consistent growth and consumption of such products in Pakistan.

The increasing preference for convenient and sustainable packaging in the FMCG and consumer goods sectors has further propelled demand for BOPP and CPP films. However, the cost of the primary raw materials for these films are closely linked to international crude oil prices, coupled with the impact of fluctuating exchange rates. During FY24, high energy costs significantly increased input expenses of the industry. This has encouraged Companies to explore alternative energy solutions, including solar power, to mitigate the challenge and improve cost efficiency.

Relative Position

MACPAC Films holds a market share of 6.82% in BOPP Films and 12.75% in CPP films segments.

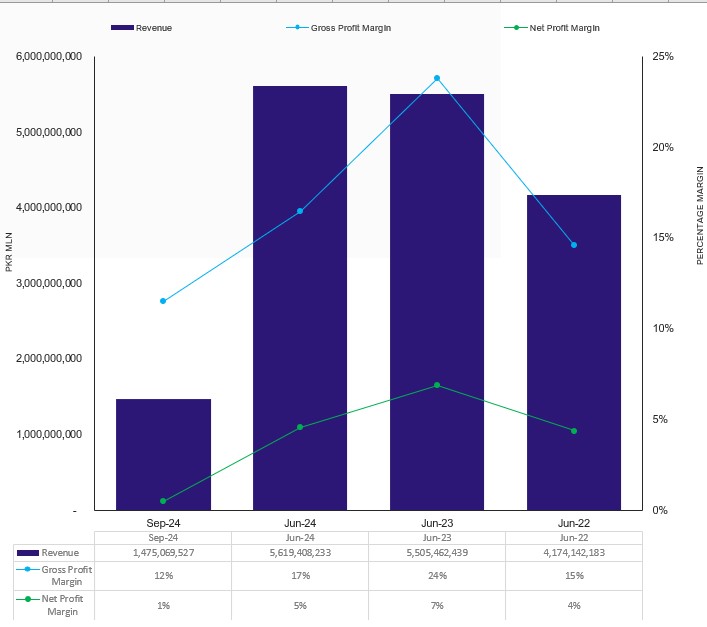

Revenues

During FY24, the revenues of the company increased to stand at PKR 5,619mln (FY23: PKR 5,505mln). During 1QFY25, the revenues of the company inclined to PKR 1,475mln (1QFY24: PKR 1,462mln).

Margins

During 1QFY25, the gross margin of the Company declined to 11.5% (1QFY24: 23.3%). The operating margin of the Company witnessed a similar trend clocking in at 3.0% (1QFY24: 16.4%). The finance cost of the Company inched down to PKR 27mln (1QFY24: PKR 33mln). Hence, the net income of the Company was recorded at PKR 7mln (1QFY24: PKR 117mln). Subsequently, the net margin declined to 0.5% (1QFY24: 8.0%). The Company successfully maintained profitability and consistently provided payouts to shareholders.

Sustainability

The Company’s commitment to sustainability underpins its product development efforts, with a focus on creating biodegradable, recyclable, and compostable packaging solutions in line with global sustainability trends. Additionally, the Company is exploring new formulations for BOPP films to enhance its product portfolio, thereby strengthening its revenue base and profitability.

Macpac Films Limited has expanded its global footprint by establishing Macpac Films Middle East LLC FZ in Dubai, strengthening its market presence in the Middle East.

Financial Risk

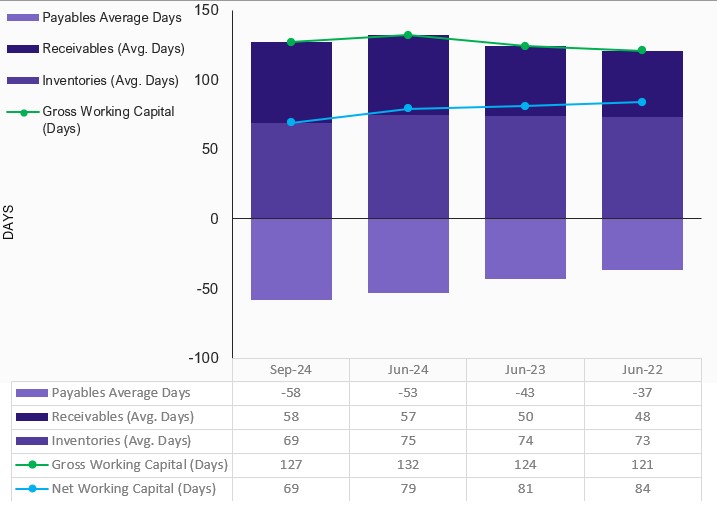

Working capital

At end-Sept24, the net working capital cycle days improved to 69 days (end-Jun24: 79 days). Furthermore, trade assets of the Company increased to stand at PKR 2,219mln (end-Jun24: PKR 2,152mln) owing to a higher trade receivable level clocking in at PKR 974mln (end-Jun24: 900mln).

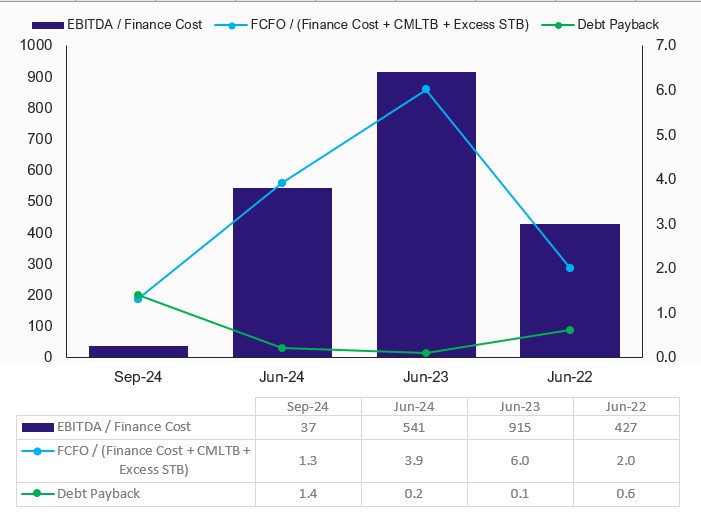

Coverages

During 1QFY25, the free cash flows declined to PKR 37mln (1QY24: PKR 251mln). The finance costs clocking in at PKR 26mln (1QFY24: PKR 33mln). Hence, the interest coverage of the Company diluted to 1.8x (1QFY24: 10.0x). The debt coverage declined to 1.3x (FY23: 6.5x), however, remained reasonable. Furthermore, the debt repayment period of the Company is inclined to 1.4 years (1Q24: 0.1 years). During 3MFY25, the FCFO's (free cash flow from opreations) increased to PKR 37mln (1QFY25: PKR 251mln).

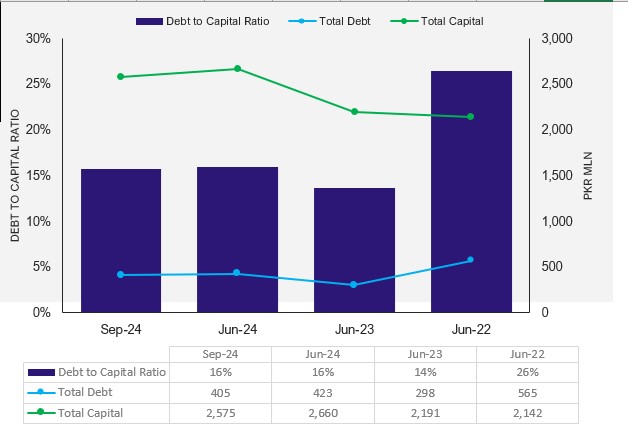

Capitalization

At end-Sept24, leverages of the Company decreased to 15.7% (end-Jun24: 15.9%) owing to a decrease in the total borrowings clocking in at PKR 405mln (end-Jun24: PKR 423mln) out of which ST borrowing constitutes 77.6%. The equity base declined to PKR 2,170mln (end-Jun23: PKR 2,237mln).

|