Profile

Legal Structure

Zahir Khan & Brothers (ZKB or the Firm) is a Partnership Firm established in 1970 and registered with the Registrar of Firms in Baluchistan under the Partnership Act, 1932. To fulfill its vision of full corporatization, the Firm has taken an initial step by establishing a corporate entity, ZKB Construction Private Limited, which is wholly owned by the Firm.

Background

ZKB, a prominent name in the construction industry, began as a modest enterprise in Balochistan in 1970. With a successful operational history spanning over five decades, ZKB has built an extensive portfolio encompassing the full spectrum of construction work. The Firm has consistently demonstrated its capability to undertake large and complex projects, delivering them on time, within budget, and to the highest standards of quality.

Operations

ZKB specializes in a wide array of construction projects, including roads and highways, bridges and overhead structures, residential and commercial buildings, canals, tunnels, water and irrigation systems, dams and flood control systems, oil and gas pipelines, industrial and prefabricated buildings. The Firm is registered with the Pakistan Engineering Council (PEC) and holds a 'CA' class license with a "NO LIMIT" designation. It boasts an extensive range of construction equipment, including pavers, power curbers, asphalt plants, bitumen distributors, transit mixers, rotary drilling machines, gantry cranes, straddle carriers, and milling machines. ZKB employs a permanent workforce and supplements it with additional labor hired temporarily to meet specific project requirements.

Ownership

Ownership Structure

ZKB is a fully family-owned business with four partners. Mr. Zahir Khan, the founder, holds the majority stake of 51%, Mr. Mohabbat Khan owns 41%, while Mr. Suleman and Mr. Samiullah each hold a 4% stake.

Stability

The Firm’s partnership structure has remained stable for decades, with no anticipated changes in the near future. However, transitioning to a corporate framework, combined with formal succession planning, is expected to further enhance its long-term stability.

Business Acumen

The sponsoring family has been in the construction industry for many decades. The sponsors possess a comprehensive understanding of the business, as they are actively involved in the day-to-day operations.

Financial Strength

The sponsors have a sound financial profile and, both individually and through the Firm, own numerous properties across various locations in the Country. This extensive asset base contributes significantly to the financial strength and stability of the Firm.

Governance

Board Structure

The overall control of the Firm rests with its four partners. In addition to the CEO, the other three partners also hold executive roles. While the governance structure ensures operational oversight, there is room for improvement, particularly as ZKB remains a partnership entity. Transitioning to a more structured corporate governance framework could enhance operational efficiency and accountability.

Members’ Profile

All the partners are highly experienced professionals. Three of them bring approximately a decade of experience in the construction industry, while Mr. Zahir Khan, the CEO and founding member of ZKB, boasts nearly five decades of expertise in the sector. His visionary leadership has been the driving force behind the Firm's success and growth.

Board Effectiveness

Currently, there are no formal committees within the Firm. All partners hold management positions, which limits the potential for impartial oversight. However, the partners actively participate in the planning and execution of business projects and regularly oversee the Firm's operations

Financial Transparency

M/s. RSM Avais Hyder Liaquat Nauman Chartered Accountants serves as the external auditor for the Firm. The auditors have issued an unqualified audit opinion on the financial statements of Zahir Khan & Brothers for the year ended June 30, 2024, reflecting the Firm's compliance with applicable financial reporting standards.

Management

Organizational Structure

ZKB has a well-documented organizational structure with operations divided into six key departments: (i) Bidding, (ii) Information Technology, (iii) Contract Management, (iv) Construction, (v) Admin & HR, and (vi) Finance. Each department has clearly defined responsibilities, ensuring efficient management and coordination across the Firm.

Management Team

Zahir Khan, the CEO, plays a central role in key decisions, particularly in bidding for government contracts. The execution of projects is managed by project managers under the supervision of Mr. Mohabbat Khan, the Director (Technical Services) and COO, who brings over 15 years of experience in the construction sector. Mr. Mohabbat Khan is supported by a skilled core management team, including Mr. Atif Iqbal, head of financial reporting and accounting, and Mr. Kamran, who heads the treasury and possesses extensive experience in banking. Together, they ensure the effective and efficient operation of the Firm.

Effectiveness

The management functions are clear and well-defined, ensuring the effective achievement of the Firm’s goals and objectives. The board members closely oversee the team to ensure successful execution. Additionally, the board plays an active role in preparing project bids. The management holds regular meetings to discuss Firm affairs, though the documentation of these meetings is not formalized.

MIS

ZKB currently utilizes SARP (ERP/Oracle) software, which has been customized specifically for the construction industry. The software efficiently manages key financial functions, including tracking receivables, payables, general ledger, and accounts, providing the Firm with comprehensive financial oversight and control.

Control Environment

The Firm adheres to strict quality control standards, understanding their critical importance in the construction industry, particularly when working with international donor agencies. Additionally, ZKB maintains a comprehensive Management Information System (MIS) that enables the management to monitor activities across various project sites. While an internal control system is in place, ongoing reviews by the partners are essential to further enhance the effectiveness of management and ensure continuous improvement

Business Risk

Industry Dynamics

The Public Sector Development Program (PSDP) for fiscal year 2024 (FY24) saw an increase of approximately 30.7% year-on-year (YoY), reaching PKR 950bln. Under the Current and Development Expenditure on the Revenue Account, a specific allocation has been made for Construction and Transport. The total amount for these sectors is PKR 40.5bln for Current Expenditure and PKR 39.1bln for Development Expenditure. In comparison to the previous fiscal year (SPLY), these figures have slightly changed, with allocations for Construction and Transport last year being PKR 30.2bln and PKR 55.2bln, respectively. In addition to infrastructure projects, the demand for hydel-based power plants is increasing with aims to improve the energy mix, with funding provided by multilateral agencies.

Relative Position

Out of the 10,000+ firms registered with the Pakistan Engineering Council as Constructors/Operators, only approximately 100 (1%), including ZKB, hold the prestigious 'CA' category (no limit) license. This license allows them to be included on the pre-qualification list of approved constructors. Additionally, ZKB's history of successfully delivering projects funded by international donors, along with its joint ventures with internationally recognized contractors, positions the Firm among the top-tier contractors operating in Pakistan.

Revenues

Due to a healthy project pipeline, the Firm recorded a top line of PKR 20,851mln during FY24 (FY23: PKR 11,207mln; FY22: PKR 9,237mln), reflecting a continuous improvement trend. The increase in revenue is driven by several major projects, including Winder Dam and Red and Yellow line BRTS, Mingora Greater water supply scheme and other Road development projects. Based on the Company's pipeline and the projects currently under bidding and prequalification stage, ZKB’s revenue is expected to grow in the upcoming years. In addition to its contract-based projects, the Firm has successfully bid for and won several Public-Private Partnership (PPP) projects. One such project is the Swat Motorway, which has been awarded to the Firm, and work on it is expected to begin soon. This diversification into PPP projects will help ensure a steady revenue base, even when the project pipeline is not as strong.

Margins

In FY24, the Firm maintained its gross and operating margins at levels comparable to the previous period. The gross margin stood at 26% (FY23: 26.7%; FY22: 16.2%), while the operating margin was recorded at 22.9% (FY23: 22.7%; FY22: 12.5%). However, net margins were reported at 42.2% (FY23: 92.4%; FY22: 14.4%), primarily driven by unrealized gains on investment properties

Sustainability

ZKB's management aims to establish a sustainable presence in the market by transitioning from a partnership to a corporate structure entity in the near future. As an initial step, the private company "ZKB Construction Private Limited" has been established. The Firm is actively pursuing geographical diversification in its business operations, with new projects in the pipeline expected to boost revenue growth. Notably, 70% of the firm's projects are financed by the Asian Development Bank, providing a buffer against political instability and turmoil. Additionally, ZKB is diversifying its business portfolio. The sponsors have acquired a sugar mill, which is 90% complete and expected to commence production soon. Furthermore, the Firm has made strategic long-term investments through its balance sheet by purchasing shares in Flow Petroleum, Pak-China Fertilizer, and Mubarak Center in Lahore, further diversifying its business profile

Financial Risk

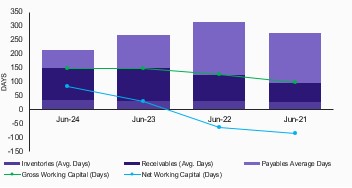

Working capital

The Firm manages its working capital primarily through funds received from customers, supplemented by a small portion of borrowings. Given the nature of its operations, the Firm maintains substantial exposure to non-funded facilities, such as performance guarantees, which are critical for securing projects. Currently, the Firm has total facilities of approx. PKR 40bln, largely utilized in the form of performance guarantees. In terms of operational efficiency, ZKB's trade receivable days stood at 114 in FY24 (FY23: 118 days), while trade payable days decreased to 66 (FY23: 120 days). The average net working capital days increased to 82 days in FY24 (FY23: 29 days), reflecting a stretched cash cycle. This trend is attributed to the early stages of projects, where the cash conversion cycle typically takes longer.

Coverages

In FY24, ZKB’s Free Cash Flow from Operations stood at PKR 3,960mln (FY23: PKR 3,442mln), driven by a gross profit of PKR 5,423mln. The interest coverage ratio stood at 9.9x in FY24 (FY23: 10.3x), indicating the Firm’s strong ability to meet its interest obligations.

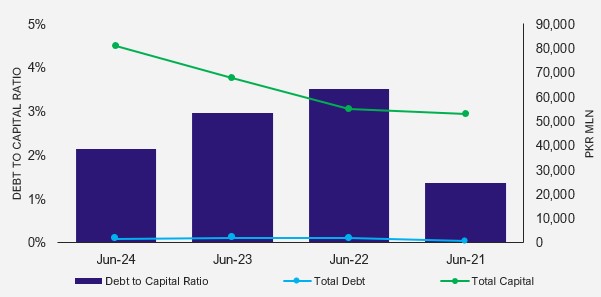

Capitalization

During FY24, the Firm's leverage ratio stood at 1.8% (FY23: 2.6%). Historically, ZKB has not relied on long-term debt to meet its business requirements. However, the management has incorporated short-term borrowings into the capital mix to support working capital needs. The Firm also has non-funded credit facilities, primarily in the form of bank guarantees provided to secure the projects. These borrowings are secured against tangible collateral, including mortgages on residential and commercial properties held in the sponsors' names.

|