Profile

Legal Structure

Tariq Glass Industries Limited (‘TGL’ or ‘the Company’) is a public listed entity incorporated in 1978, under the Companies Act 1913 (now “Companies Act, 2017”). The Company’s registered office is situated at 128-J, Model Town, Lahore.

Background

M/s Nasir Sadiq Corporation (Pakistan) Limited was incorporated in 1978 as a private limited company and was later converted its status to a public limited company in 1980. The Company has been listed on the Pakistan Stock Exchange since 1984. Subsequently, the Company changed its name to ‘Tariq Glass Industries Limited’ in 1996. With an operating history of over four decades, the Company has emerged as one of the top players in the glassware industry in Pakistan.

Operations

The Company is engaged in the manufacturing and sale of tableware, float glass, and glass containers with an accumulated glass pulled production capacity of ~226,176 MTons per annum as of June 24 (242,163 MTA, FY23). The production facilities include two plants each of float glass and tableware having cumulative capacities of 1,050 Tons per Day (TPD) and 340 TPD respectively out of which the Company has a 70 TPD plant capacity for manufacturing glass containers. The manufacturing facilities are located at 33KM-Lahore Sheikhupura Road, Sheikhupura, Punjab.

Ownership

Ownership Structure

The sponsoring family cumulatively holds ~48.57% directly and ~11.79% through associated companies. Whereas, ~20.52% is held by the general public followed by ~8.71% held by Modarbas and Mutual Funds, and the remaining ~10.41% is held by others including Banks, DFIs, Insurance Companies, NBFIs etc.

Stability

The majority of the Company’s shares are held by the sponsoring family, and the ownership structure has remained largely unchanged over the years, reflecting a stable ownership foundation. It is expected that the majority shareholding will continue to remain with the sponsoring family for the foreseeable future.

Business Acumen

The sponsoring family has been involved in the glass manufacturing industry since the inception of Tariq Glass Industries Limited. Their expertise and leadership have been pivotal in the Company’s growth, helping it evolve into one of the largest players in the glass manufacturing sector.

Financial Strength

The financial strength of the sponsors is considered adequate. Mr. Omer Baig plays a pivotal role in the Company and holds a dominant position within the industry. Tariq Glass Industries Limited is the family’s primary business, and they do not hold any strategic stakes in other companies.

Governance

Board Structure

The Board of Directors consists of seven members: two executive directors, including the Managing Director/CEO; three non-executive directors, one of whom is a female director; and two independent directors.

Members’ Profile

Mr. Mansoor Irfani serves as the Chairman of the Board. A seasoned veteran of the Armed Forces of Pakistan, he has been with the Company for over four decades. Four of the board members possess extensive experience in the glass industry, while the remaining members are accomplished professionals with significant expertise in managing business affairs across various sectors. To ensure continuous development, Tariq Glass regularly organizes training programs for its executive directors.

Board Effectiveness

The Board meets at least quarterly, following a pre-defined agenda, to oversee management performance and provide strategic direction. During FY24, five Board meetings were held, with strong attendance from the directors. Minutes of the meetings are properly documented, and action points are communicated to the relevant stakeholders. Additionally, the Board has established two committees: (i) the Audit Committee and (ii) the HR Committee, both chaired by independent directors. These committees enhance the Board’s effectiveness by offering focused oversight and ensuring the implementation of the Board’s policies.

Financial Transparency

The Company's external auditors, M/s Crowe Hussain Chaudhry & Co. Chartered Accountants, are classified in the 'A' category on the SBP’s panel of auditors. They have issued an unqualified opinion on the Company’s annual financial statements for the year ending June 30th, 2024, confirming their satisfaction with the Company’s compliance with applicable policies and accounting principles.

Management

Organizational Structure

TGL has a well-defined organizational structure, comprising six primary functional departments: (i) Internal Audit, (ii) Human Resources/Administration, (iii) Sales, (iv) Operations, (v) Finance & Accounts, and (vi) Information Technology. Each department is structured with a multilayered hierarchy and is led by a qualified professional. Currently, all key positions within the organization are filled.

Management Team

Mr. Omer Baig serves as the Managing Director/CEO of the Company. He holds a degree in Business Studies from the USA and subsequently joined the family business. His leadership has been a key driver of the Company’s growth. He is supported by a team of seasoned professionals with extensive experience across various sectors. Notably, Mr. Waqar Ullah, the Company’s CFO, is a qualified Chartered Accountant and has been with the Company for over four decades.

Effectiveness

A structured and multi-layered hierarchy exists within the Company with clearly defined roles and responsibilities which enhances the effectiveness of its Management. The establishment of management committees would further enhance the management’s efficiency by bridging inter-departmental gaps and fostering better collaboration.

MIS

TGL is equipped with the latest SAP solution, SAP S/4 HANA, to meet its IT requirements. The software is fully integrated comprising all the key modules, providing real-time data that supports the management's needs and strengthens effective decision-making.

Control Environment

The Company has an in-house internal audit function that reports directly to the Board’s Audit Committee. It conducts periodic reviews to identify, assess, and mitigate risks arising from business operations, while ensuring the implementation of approved policies and procedures. Additionally, the Company's corporate structure is divided into various departments, each with an effective internal control system to ensure the achievement of strategic goals and reliable reporting.

Business Risk

Industry Dynamics

Pakistan's glass manufacturing sector consists of 5 to 6 large organized players and numerous smaller, unorganized competitors, spanning product segments such as float glass, containers, and tableware. In FY24, the sector's estimated revenue reached PKR 85,248 million, reflecting a year-on-year growth of approximately 12.8%. However, industry volumes were impacted by a slowdown in construction activity. Additionally, glass manufacturing is an energy-intensive process, and the sector faced significant challenges due to a sharp increase in energy prices during the year. Elevated interest rates also exerted pressure on the sector’s profitability.

Relative Position

TGL has grown to become one of the largest and leading manufacturers and suppliers of tableware, float glass, and glass container ware in Pakistan. The management claims to hold a market share of ~50% each in both the tableware and float glass markets.

Revenues

During FY24, the company's topline showed a marginal growth of 4.1% year-on-year, primarily attributable to price hikes as volumes remained subdued owing to dampened demand due to a slowdown in the construction sector prompting the Company to keep two of its furnaces inactive. Sales in the local market contributed ~92% to the overall revenue whereas ~8% was contributed by exports. Furthermore, during 1QFY25, the Company’s sales declined by ~0.45% compared to same period last year and were recorded at PKR 6,888mln.

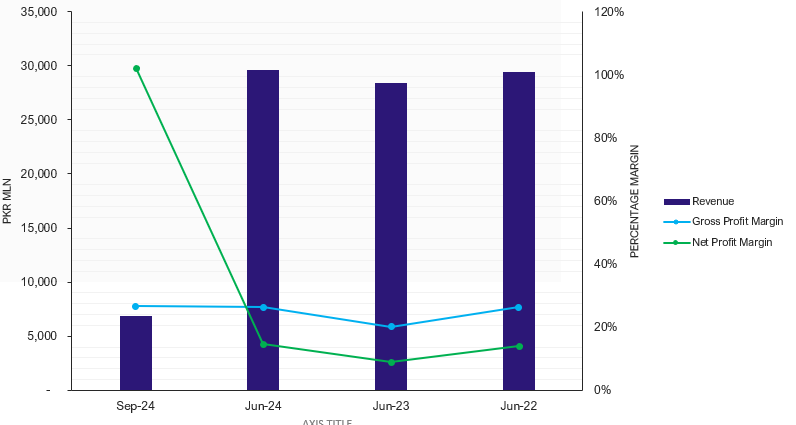

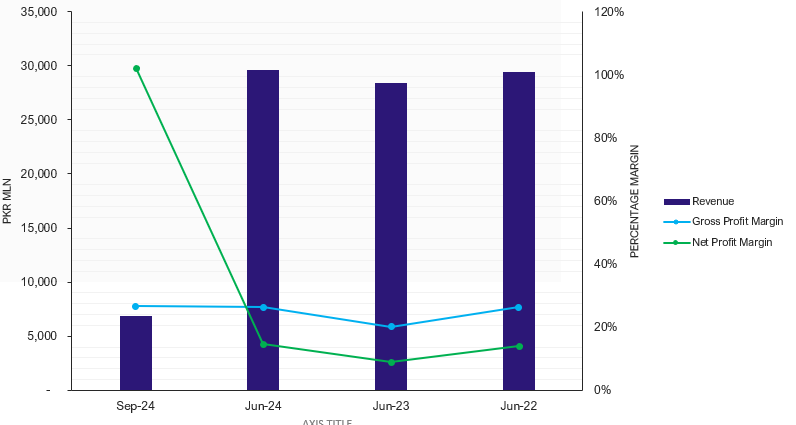

Chart-1: Revenue & Margins

Margins

The margins of the Company have shown improvement at all levels during FY24 mainly on the back of price hikes to pass on the impact of elevated costs and efficient management of the energy mix. The Company has recorded a gross profit margin of 26.4% during the year compared to 20.2% during FY23. The net profit margin also improved to ~14.8% during the year primarily attributable to the recognition of a bargain purchase of PKR 915mln on account of the acquisition of MMM Holdings (Pvt.) Ltd, signifying a one-off transaction. Furthermore, the Company sustained its gross profit margin at ~26.7% during 1QFY25. However, the net profit margin reverted to its median level and was recorded at 10.2% during the period.

Sustainability

TGL has entered into J.V (a green field project) with ICI Pakistan and incorporated a new entity Lucky TG (Pvt) Ltd to produce 1,000 TPD of float glass. This will further augment its revenue streams and supplement the exploration of the untapped global export market of glass. The Company has also acquired Baluchistan Glass Ltd. through MMM Holding (Pvt.) Ltd, through which the management intends to expand its product portfolio in the tableware, container ware and pharmaceutical packaging glass markets.

Financial Risk

Working capital

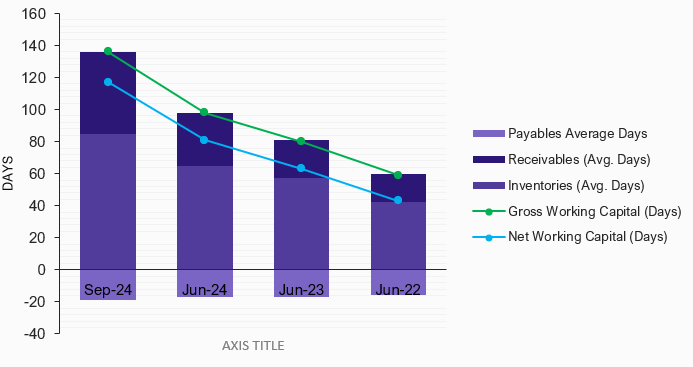

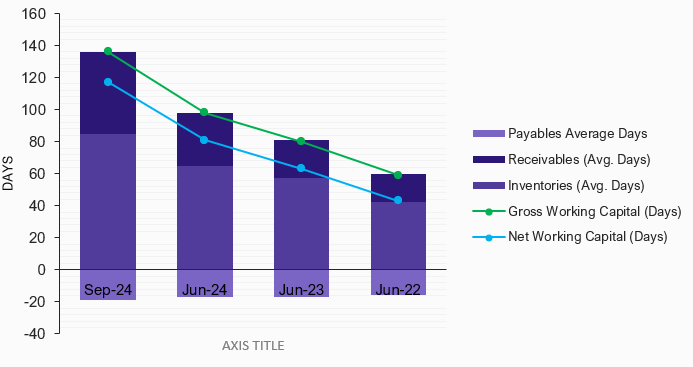

The Company's net working capital days increased to 81 days in FY24 (FY23 64 days), reflecting a slightly stretched cash cycle owing to an increase in inventory level and increased receivables. The Company had a short-term trade leverage of `54% as of June-2024, reflecting sufficient room for borrowing available to the Company. During 1QFY24, the Company’s cash cycle further stretched to ~116 days stemming from the aforementioned factors.

Chart-2: Working Capital

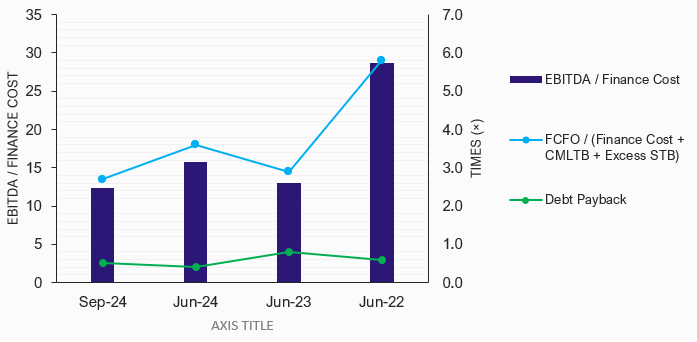

Coverages

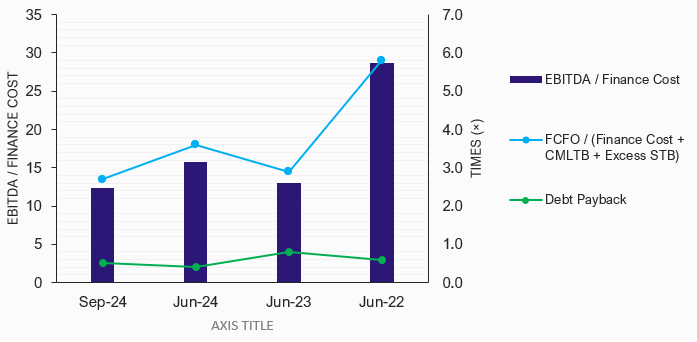

The Company generated FCFO of PKR 5,639mln during FY24 compared to PKR 4,022mln in FY23, primarily on the back of higher profitability which also triggered an improvement in interest and debt coverages of the Company as reflected by the interest and debt coverage ratios of 15.8x and 0.4 times respectively during FY24 compared to 13x and 0.8 times in FY23. Furthermore, during 1QFY24, the Company sustained healthy coverages.

Chart-3: Coverages

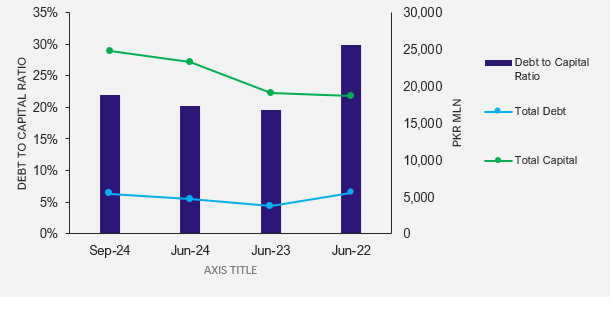

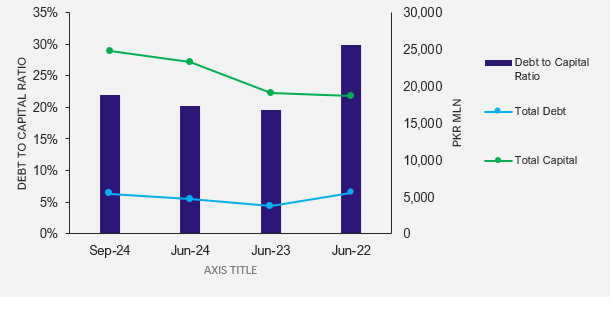

Capitalization

The Company had a low leveraged capital structure as of FY24 as indicated by the debt to the capital ratio of 20.2% (FY23, 19.6%). TGL had short-term borrowings of PKR 2,487mln as of June-2024 (FY23: PKR 922mln) which constituted ~53% of the total debt and were utilized to manage working capital requirements. Furthermore, the long-term borrowings of the company stood at PKR 1,161mln as of June-2024 and primarily comprised concessionary borrowings to fund expansion. During, 1QFY25, the Company’s leverage increased marginally to ~22% on the back of an increase in short-term borrowings.

Chart-4: Capitalization

|